Calculate your income tax effortlessly with our India-specific tool. Get clear insights on your tax liabilities and plan ahead. Try it today!

User Guide for Income Tax Calculator

Use our Income Tax Calculator for India to find out your potential tax savings. It’s simple and fast. Take control of your taxes now!

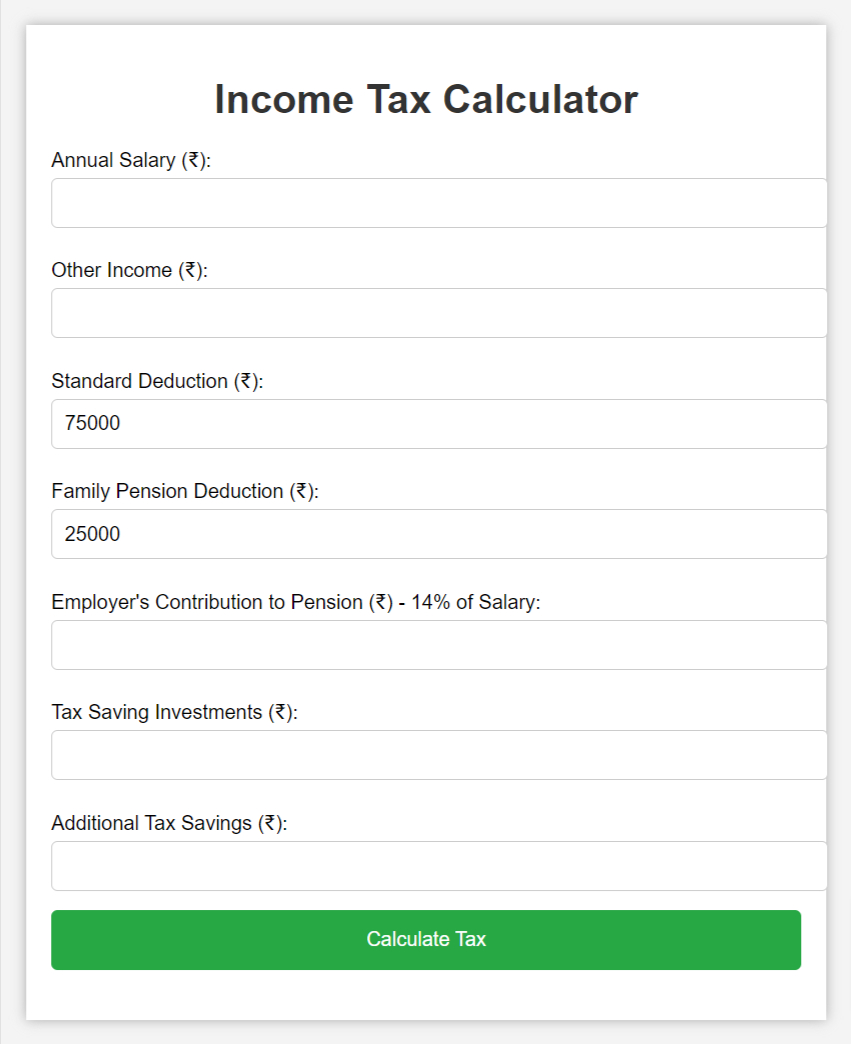

This Income Tax Calculator helps you estimate your income tax liability based on your salary, other income sources, and eligible deductions.

Step-by-Step Instructions

Step 1: Open the Calculator

- Open the calculator in your browser to access the input form and tax calculation interface.

Step 2: Enter Your Annual Salary

- In the Annual Salary (₹) field, enter your total annual salary income in Indian Rupees (₹).

- Example: If you earn ₹10,00,000 annually, enter 1000000.

Step 3: Enter Other Income

- In the Other Income (₹) field, input any additional income apart from your salary (e.g., income from investments, freelance work, etc.).

- Example: If you earn ₹50,000 from other sources, enter 50000.

Step 4: Standard Deduction

- The Standard Deduction (₹) is pre-filled at ₹75,000. This is a fixed deduction available to all salaried individuals. No need to modify unless applicable.

Step 5: Family Pension Deduction

- The Family Pension Deduction (₹) is pre-filled at ₹25,000. This field is for pensioners or individuals receiving family pensions. You can modify this if applicable to your case.

Step 6: Employer’s Contribution to Pension

- In the Employer’s Contribution to Pension (₹) field, enter the pension amount your employer contributes. The calculator assumes this to be a maximum of 14% of your salary.

- Example: If your employer contributes ₹70,000, enter 70000.

Step 7: Tax Saving Investments

- Enter the total amount of tax-saving investments under Section 80C (e.g., PPF, EPF, life insurance premiums, etc.) in the Tax Saving Investments (₹) field.

- Example: If you have invested ₹1,50,000 in PPF, enter 150000.

Step 8: Additional Tax Savings

- In the Additional Tax Savings (₹) field, enter any additional deductions such as those under Section 80D (health insurance), Section 80E (education loan interest), etc.

- Example: If you have ₹25,000 of additional savings, enter 25000.

Step 9: Calculate Tax

- Once all the required fields are filled in, click on the Calculate Tax button to process your tax information.

Step 10: View Results

- After clicking “Calculate Tax,” the results will display the following:

- Total Income: This is the sum of your annual salary and other income.

- Total Deductions: This is the total amount of deductions, including standard deduction, family pension, employer pension contribution, and tax-saving investments.

- Taxable Income: The total taxable income after subtracting deductions from your total income.

- Total Tax Payable: This is the final amount of tax you need to pay based on your taxable income and tax slab rates under the new tax regime.

Discover how much tax you need to pay with our easy Income Tax Calculator for India. Enjoy stress-free tax planning. Start calculating today!

Example Scenario

- Annual Salary: ₹10,00,000

- Other Income: ₹50,000

- Standard Deduction: ₹75,000 (default)

- Family Pension Deduction: ₹25,000 (default)

- Employer Pension Contribution: ₹70,000

- Tax Saving Investments: ₹1,50,000

- Additional Tax Savings: ₹25,000

After filling in these values and clicking Calculate Tax, the calculator will display the Total Tax Payable based on your taxable income and tax deductions.

Notes:

- The tax is calculated as per the new tax regime slabs.

- Ensure that all values are entered accurately for correct tax estimation.

- The calculator assumes Indian tax rules applicable for the FY 2024-25.

Use this tool for an estimate of your tax liability. For exact calculations, consider consulting a tax professional.

Try More Calculators:

- Advanced Income Tax Calculator

- Salary Breakdown Calculator

- Net Salary Calculator

- APY Calculator

- Salary Calculator

Understanding the Income Tax Calculator: A Must-Have Tool for Tax Planning

Income tax is an essential part of personal finance, and understanding how much tax you’re liable to pay can help you plan your finances more effectively. For many, calculating income tax manually can be a daunting task, especially with various tax slabs, exemptions, and deductions in place. This is where an Income Tax Calculator becomes a valuable tool.

In this blog, we’ll explore what an income tax calculator is, how it works, and why you should use one for efficient tax planning.

What Is an Income Tax Calculator?

An Income Tax Calculator is an online tool that helps individuals calculate their tax liability based on their annual income, deductions, exemptions, and applicable tax rates. It takes into account various factors like salary, other income (such as rental income or interest), and eligible deductions under the Income Tax Act (such as those under sections 80C, 80D, 80TTA, etc.).

By inputting your financial details, the calculator quickly computes the amount of tax you owe, providing a clear picture of your taxable income and the deductions you can claim.

How Does an Income Tax Calculator Work?

Using an income tax calculator is a straightforward process. Here’s how it generally works:

Step 1: Input Your Income Details

- You will be prompted to enter your annual salary and other sources of income, such as rental income or interest earned from savings.

Step 2: Enter Deductions

- The calculator allows you to input deductions under various sections like 80C, 80D, 80TTA/TTB, and others. These deductions help lower your taxable income and reduce your tax liability.

Step 3: Taxable Income Calculation

- After you enter all income and deduction details, the calculator automatically computes your taxable income (i.e., total income minus eligible deductions).

Step 4: Tax Calculation Based on Tax Slabs

- Depending on the taxable income, the calculator applies the relevant tax slabs (as per the chosen tax regime—new or old). The tax slabs for the financial year 2024-25 under the new regime are as follows:

- 0% for income up to ₹3,00,000

- 5% for income from ₹3,00,001 to ₹7,00,000

- 10% for income from ₹7,00,001 to ₹10,00,000

- 15% for income from ₹10,00,001 to ₹12,00,000

- 20% for income from ₹12,00,001 to ₹15,00,000

- 30% for income above ₹15,00,000

Step 5: Final Tax Payable

- The final output provides you with the total tax payable based on your taxable income and deductions.

Why Should You Use an Income Tax Calculator?

- Ease of Calculation: Income tax calculators simplify the tax calculation process. They eliminate the need for manual calculations, which can be time-consuming and prone to errors. You only need to input your income and deduction details, and the tool does the rest.

- Accurate Results: Since the income tax calculator is programmed to follow the latest tax laws, you get accurate tax computations. This helps you avoid miscalculations, especially when dealing with complex tax structures.

- Tax Planning and Optimization: An income tax calculator can be a powerful tool for tax planning. It allows you to see the impact of different deductions, helping you identify ways to minimize your tax liability legally. For example, if you realize you’re not using all available deductions (like under 80C or 80D), you can make informed decisions on how to save more on taxes.

- Comparison Between Tax Regimes: With the option to choose between the new tax regime and the old tax regime, the calculator helps you make an informed decision about which regime is better suited for your financial situation. This comparison can lead to significant tax savings.

- Faster and Convenient: Using an online calculator is far more convenient than relying on tax consultants or spending time with pen and paper. It provides quick results, making it easier for you to file taxes on time.

- Planning Investments: By knowing your tax liability in advance, you can plan investments in tax-saving schemes like ELSS funds, PPF, or NPS to reduce your taxable income and ultimately pay less tax.

Features of an Income Tax Calculator

A good income tax calculator goes beyond just basic tax calculations. Some of the advanced features you can expect include:

- Standard Deduction: Automatically applied, simplifying the process for salaried individuals.

- Multiple Income Sources: Easily input other income like rent, interest, or freelance income.

- Investment Deductions: Ability to input eligible deductions under various sections (e.g., 80C for investments like EPF, PPF, and insurance premiums).

- Exemptions for Seniors: Some calculators also offer special fields for senior citizens, accounting for different exemption limits.

- Real-Time Results: As you input the data, results are generated instantly, giving you immediate insights.

How to Use an Income Tax Calculator for Efficient Tax Planning

- Gather Your Income Details: Have a clear understanding of all your income sources. Include your salary, rental income, interest earned, and any other income streams.

- List Your Deductions: Make sure you know what tax-saving investments and deductions you can claim. These might include contributions to PF, insurance premiums, medical expenses, education loans, etc.

- Compare Tax Regimes: Use the calculator to compare the tax implications under both the old and new regimes. This will help you determine which tax regime offers the most benefits.

- Plan Investments Accordingly: Once you know your taxable income and deductions, you can decide if further investments in tax-saving instruments are necessary to bring down your tax liability.

Conclusion

An Income Tax Calculator is an indispensable tool for anyone looking to manage their taxes more effectively. It not only helps you understand how much tax you need to pay but also allows you to optimize your finances by making informed investment decisions. Whether you’re a salaried employee, a freelancer, or a business owner, using an income tax calculator can save you time, reduce errors, and help you plan for the future.

Use our Income Tax Calculator today to take control of your taxes and ensure you are making the most of every tax-saving opportunity available to you!

A Comprehensive Guide to Income Tax in India: What You Need to Know

Income tax is a crucial part of the Indian financial system, as it plays a key role in funding the government’s infrastructure, development, and welfare projects. For individuals and businesses alike, understanding income tax is essential for managing finances and ensuring compliance with legal obligations. In this blog post, we will explore the basics of income tax in India, its importance, how it is calculated, and the various provisions available for taxpayers.

What is Income Tax?

Income tax is a tax imposed by the government on the income earned by individuals, businesses, and other entities. In India, income tax is governed by the Income Tax Act of 1961, which lays out the rules and regulations related to tax collection, exemptions, and penalties. The income tax system in India is progressive, meaning the rate of taxation increases as the taxable income rises.

Individuals are required to file their tax returns every financial year (April 1 to March 31), declaring their total income from various sources and paying taxes based on the applicable tax slabs.

Why is Income Tax Important?

- Revenue Generation for the Government: Income tax is a major source of revenue for the government. The funds collected through taxes are used for the development of public infrastructure such as roads, hospitals, schools, defense, and social welfare programs.

- Redistribution of Wealth: Income tax helps in reducing the disparity between different income groups. With higher tax rates for those earning more, the government aims to redistribute wealth more equitably.

- Encourages Savings and Investments: To promote savings and investments, the government offers various tax deductions and exemptions under sections like 80C, 80D, and 80G. These provisions not only reduce the tax burden but also encourage people to invest in long-term financial instruments like PPF, NPS, Life Insurance, etc.

- Legal Obligation: Filing income tax returns is a legal requirement for individuals and businesses who meet the income criteria. Non-compliance can lead to fines and legal penalties.

Types of Income Subject to Tax

In India, income from various sources is subject to taxation. These sources are classified into five broad categories:

- Income from Salary: This includes the salary, pension, and allowances received by an individual. For salaried employees, certain allowances like House Rent Allowance (HRA) and Leave Travel Allowance (LTA) are partially or fully exempt from tax.

- Income from House Property: Income earned from renting out property is taxable under this head. The owner can claim deductions for home loan interest and municipal taxes paid on the property.

- Income from Capital Gains: Any profit or gain from the sale of capital assets, such as property, stocks, or mutual funds, is taxable as capital gains. These are divided into short-term and long-term capital gains, with different tax rates applicable for each.

- Income from Business or Profession: Profits earned from a business or profession fall under this category. Individuals, freelancers, and businesses need to declare their net income after deducting business expenses.

- Income from Other Sources: This includes income from savings accounts, fixed deposits, dividends, lottery winnings, etc. Interest earned from savings accounts can be claimed under Section 80TTA, while senior citizens can claim up to ₹50,000 under Section 80TTB.

How is Income Tax Calculated?

Income tax is calculated based on the total income earned during the financial year. The income is first classified under the different heads mentioned above, and deductions are applied as per the Income Tax Act. Once the total taxable income is computed, the tax is calculated based on the applicable tax slabs.

For the financial year 2024-25, individuals can choose between the new tax regime and the old tax regime. Each has its own tax slabs and benefits:

New Tax Regime (FY 2024-25):

- ₹0 to ₹3,00,000: No tax

- ₹3,00,001 to ₹7,00,000: 5%

- ₹7,00,001 to ₹10,00,000: 10%

- ₹10,00,001 to ₹12,00,000: 15%

- ₹12,00,001 to ₹15,00,000: 20%

- ₹15,00,001 and above: 30%

Old Tax Regime: In the old regime, tax rates vary based on the income and age of the individual, with different slabs for individuals under 60, senior citizens (60-80 years), and super senior citizens (80+). Additionally, the old regime allows for various deductions under Sections 80C, 80D, and others, while the new regime offers lower tax rates but fewer deductions.

Key Deductions and Exemptions Under the Income Tax Act

- Section 80C: One of the most popular sections, 80C, allows deductions of up to ₹1.5 lakh on investments made in ELSS funds, PPF, NSC, Life Insurance premiums, and more.

- Section 80D: You can claim deductions for medical insurance premiums paid for yourself, your family, and your parents. The deduction limit is ₹25,000 (for self and family) and ₹50,000 for senior citizens.

- Section 80G: Donations made to certain charities and organizations are eligible for deductions under 80G. The deduction can be 50% or 100% of the donated amount, depending on the organization.

- Section 80E: This section provides a deduction for the interest paid on education loans for higher studies. There is no upper limit on the deduction, and it is available for a maximum of eight years.

- Section 80TTA/TTB: Interest earned on savings accounts can be claimed under 80TTA for up to ₹10,000 per year. Senior citizens can claim interest on savings and fixed deposits up to ₹50,000 under 80TTB.

- Home Loan Interest Deduction: Under Section 24(b), taxpayers can claim a deduction of up to ₹2 lakh on home loan interest paid for a self-occupied property. For rented properties, the entire interest is deductible.

Filing Your Income Tax Return (ITR)

Filing your Income Tax Return (ITR) is a legal obligation for individuals who meet certain income criteria. Filing returns ensures that you comply with the law and allows you to claim refunds for any excess tax paid.

Here’s how to file your ITR:

- Choose the Correct ITR Form: Different forms are available depending on your income type (e.g., ITR-1 for salaried individuals, ITR-4 for business income).

- Compile Documents: Keep your Form 16, investment proof, bank statements, and other relevant documents handy before filing.

- File Online: The most common method is e-filing on the Income Tax Department’s website. You can also use a professional tax consultant or e-filing platforms for assistance.

Conclusion

Income tax is a vital aspect of managing personal and business finances. By understanding the tax slabs, deductions, and the process of filing returns, you can ensure that you are not only compliant with the law but also minimizing your tax liability through smart investments and financial planning.

Whether you opt for the new tax regime or the old tax regime, staying informed about the latest tax provisions can help you save significantly. Don’t forget to file your ITR on time and claim all eligible deductions to make the most of the opportunities offered by the Income Tax Act.

Disclaimer

The information provided in this blog post is for general informational purposes only and does not constitute financial, tax, or legal advice. While we strive to ensure that the content is accurate and up-to-date, tax laws and regulations are subject to change, and the application of these laws can vary depending on individual circumstances.

Always consult a qualified tax professional or financial advisor for personalized advice tailored to your specific situation. We do not accept any liability for any loss or damage arising directly or indirectly from the use of, or reliance on, the information provided in this blog. The examples and calculations are illustrative and may not reflect the most current tax regulations.

Please ensure that you verify any information with official sources or professional advisors before making financial decisions or filing your income tax returns.