Use our easy future value inflation calculator to see how inflation affects your investments. Take control of your financial future now!

Documentation for Future Value Inflation Calculator

- Want to know your savings’ future value? Use our inflation calculator for quick insights and smart decisions. Start calculating today!

- Our inflation calculator helps estimate your money’s future value. Understand inflation’s impact and secure your financial goals now!

- Find out what your money will be worth in the future with our inflation calculator. Plan better and grow your wealth—try it now!

Introduction

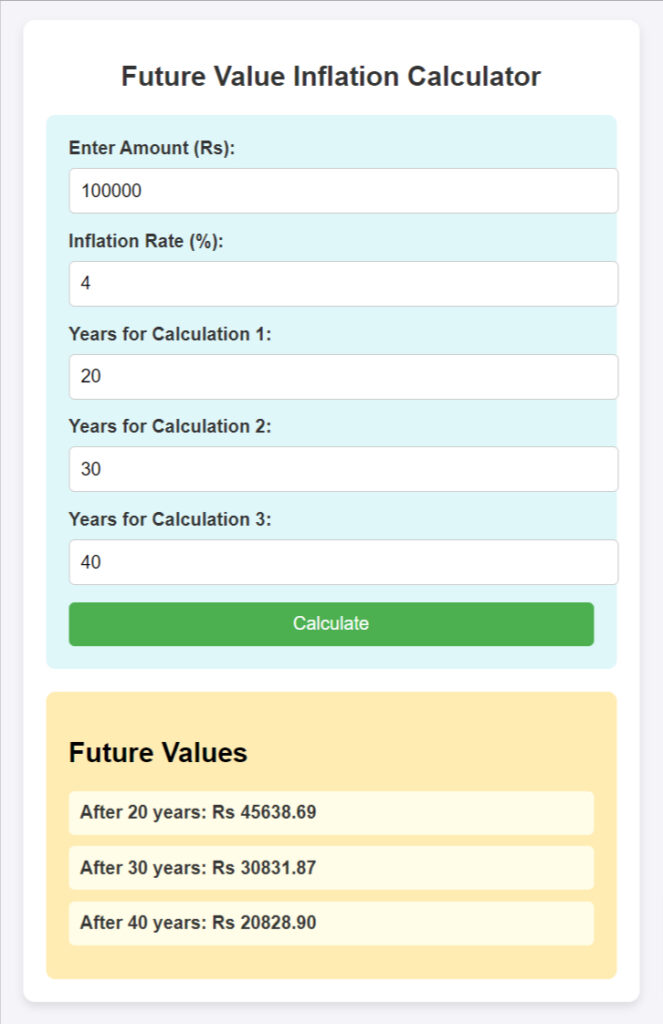

The Future Value Inflation Calculator is a web-based tool designed to estimate the future value of money considering the effects of inflation. This tool helps users understand how the purchasing power of their money will change over time due to inflation, allowing for more informed financial planning and investment decisions.

Features

Input Fields

- Amount (Rs): The present value of money you want to calculate the future value for.

- Inflation Rate (%): The expected annual inflation rate, which is used to adjust the future value of the amount.

- Years for Calculation 1: Number of years for the first future value calculation.

- Years for Calculation 2: Number of years for the second future value calculation.

- Years for Calculation 3: Number of years for the third future value calculation.

Calculate Button

- Initiates the calculation of future values based on the provided inputs.

Result Display

- Shows the future value of the money for three different time periods.

CSS Styles

The CSS styles are applied to ensure a visually appealing and user-friendly interface. Key styles include:

- General Styles: Set the font, background color, and alignment for the body and calculator container.

- Header Styles: Center-align the title and set font size and color.

- Input Section Styles: Style the input fields and labels for clarity and usability.

- Result Section Styles: Style the result section and boxes to clearly present the future value calculations.

JavaScript Function

calculateFutureValue() Function:

- Purpose: Calculates the future value of money adjusted for inflation and updates the result section.

- Steps:

- Fetches values from input fields.

- Validates input values to ensure they are numbers.

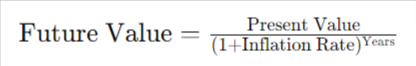

- Uses the formula Future Value = Present Value / (1 + Inflation Rate)^Years to calculate future values.

- Displays the calculated future values in the result section.

- Shows the result section.

Formula Explanation

The formula used adjusts the present value of money based on a specified inflation rate over a given number of years. This helps users understand how inflation will affect the value of their money over time.

Usage Instructions

- Enter the Current Amount: Input the amount of money you want to evaluate.

- Set the Inflation Rate: Specify the annual inflation rate as a percentage.

- Specify the Number of Years: Provide the number of years for which you want to project the future value (up to three different periods).

- Calculate: Click the “Calculate” button to see how the value of your money will change over time.

- Review Results: The results will show the future value of your money for each specified time period, adjusted for inflation.

This documentation provides a comprehensive overview of the Future Value Inflation Calculator, its functionality, and how users can utilize it for effective financial planning.

User Guide: How to Use Future Value Inflation Calculator

Welcome to the Future Value Inflation Calculator! This tool helps you estimate how the value of your money will change over time considering inflation. Here’s a step-by-step guide on how to use it:

Step 1. Open the Calculator

Open the calculator on your device. You will see a user-friendly interface with input fields and a “Calculate” button.

Step 2. Enter Amount

- Label: Enter Amount (Rs):

- Input Field: amount

- Description: Enter the current value of money you want to analyze. For example, if you have Rs 100,000 today, input 100000.

Step 3. Enter Inflation Rate

- Label: Inflation Rate (%):

- Input Field: inflationRate

- Description: Enter the expected annual inflation rate as a percentage. For example, if you expect an inflation rate of 4%, input 4. The calculator will adjust this to a decimal value (e.g., 4% becomes 0.04).

Step 4. Enter Number of Years for Each Calculation

You can perform calculations for three different time periods. Enter the number of years for each period:

- Label: Years for Calculation 1:

- Input Field: years1

- Example: Enter 20 for a 20-year period.

- Label: Years for Calculation 2:

- Input Field: years2

- Example: Enter 30 for a 30-year period.

- Label: Years for Calculation 3:

- Input Field: years3

- Example: Enter 40 for a 40-year period.

Step 5. Calculate Future Values

- Button: Calculate

- Action: Click the “Calculate” button to process the data you entered.

Step 6. View Results

After clicking “Calculate,” the results will appear in the Result Section:

- Result Box 1:

- Description: Displays the future value of the amount after the number of years specified in Years for Calculation 1.

- Example: After 20 years: Rs 45,000.00

- Result Box 2:

- Description: Displays the future value of the amount after the number of years specified in Years for Calculation 2.

- Example: After 30 years: Rs 30,000.00

- Result Box 3:

- Description: Displays the future value of the amount after the number of years specified in Years for Calculation 3.

- Example: After 40 years: Rs 20,000.00

The results will show how the purchasing power of your money decreases over time due to inflation.

Additional Tips

- Input Accuracy: Ensure all input fields are filled with valid numbers. The calculator will prompt an error if any field is left empty or contains invalid data.

- Refreshing Results: To perform a new calculation with different inputs, simply change the values and click “Calculate” again.

- Understanding Results: The results display the estimated future value of your money in today’s terms, showing how inflation erodes its value over the specified periods.

Feel free to use this calculator whenever you need to estimate the impact of inflation on your savings or investments! If you have any questions or need further assistance, please contact our support team.

Try More Calculators:

- Income Tax Calculator

- Advanced Income Tax Calculator

- Salary Breakdown Calculator

- Net Salary Calculator

- APY Calculator

Understanding the Future Value Inflation Calculator: A Guide to Financial Planning

In today’s dynamic economic environment, understanding the future value of your money is crucial for effective financial planning. Inflation is a key factor that affects the purchasing power of your savings and investments over time. This is where the Future Value Inflation Calculator becomes an invaluable tool. In this blog post, we’ll explore what this calculator is, how it works, and how you can use it to plan your financial future.

What is a Future Value Inflation Calculator?

A Future Value Inflation Calculator is a tool designed to estimate the future value of money, considering the effects of inflation. Inflation diminishes the purchasing power of money over time, meaning that the same amount of money will buy fewer goods and services in the future than it does today.

The calculator helps you determine how much today’s money will be worth in the future, taking into account the inflation rate over a specified number of years. This can be particularly useful for assessing long-term investments, retirement planning, and savings goals.

How Does It Work?

The calculator uses the formula:

Future Value=Present Value(1+Inflation Rate)Years\text{Future Value} = \frac{\text{Present Value}}{(1 + \text{Inflation Rate})^{\text{Years}}}Future Value=(1+Inflation Rate)YearsPresent Value

- Present Value: The current amount of money you want to evaluate.

- Inflation Rate: The annual rate at which inflation is expected to occur, expressed as a percentage.

- Years: The number of years over which inflation will affect the value of the money.

Here’s a step-by-step guide on how to use the Future Value Inflation Calculator:

Step 1. Enter the Present Value:

- This is the amount of money you currently have or plan to invest. For example, if you have Rs 100,000, enter 100000.

Step 2. Input the Inflation Rate:

- Enter the expected annual inflation rate as a percentage. For instance, if you anticipate an inflation rate of 4%, input 4. The calculator will automatically convert this to a decimal for calculation purposes.

Step 3. Specify the Number of Years:

- Determine how long you want to project into the future. You can perform calculations for multiple time periods, such as 20, 30, and 40 years.

Step 4. Click Calculate:

- The calculator will use the entered values to compute the future value of your money, showing how much it will be worth in today’s terms after accounting for inflation.

Step 5. Review the Results:

- The results will display the future value of your money for each period you specified. This helps you understand how inflation will erode the value of your money over time.

Why Is It Important?

Understanding the future value of your money in the context of inflation is crucial for several reasons:

- Investment Planning: Investors use inflation-adjusted calculations to gauge the real return on their investments. This helps in choosing investment options that provide returns higher than the inflation rate.

- Retirement Planning: Knowing how inflation will impact your savings can help you set more accurate retirement goals and ensure you have sufficient funds to maintain your standard of living.

- Savings Goals: Whether you’re saving for a major purchase or for future education expenses, understanding how inflation affects your savings helps you plan more effectively and avoid shortfalls.

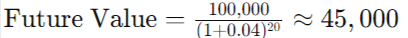

Example Calculation

Let’s say you have Rs 100,000 today, and you expect an annual inflation rate of 4%. You want to know how much this amount will be worth in 20, 30, and 40 years.

Using the formula:

- For 20 years:

Future Value=100,000(1+0.04)20≈45,000\text{Future Value} = \frac{100,000}{(1 + 0.04)^{20}} \approx 45,000Future Value=(1+0.04)20100,000≈45,000

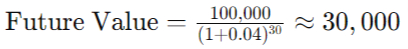

- For 30 years:

Future Value=100,000(1+0.04)30≈30,000\text{Future Value} = \frac{100,000}{(1 + 0.04)^{30}} \approx 30,000Future Value=(1+0.04)30100,000≈30,000

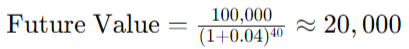

- For 40 years:

Future Value=100,000(1+0.04)40≈20,000\text{Future Value} = \frac{100,000}{(1 + 0.04)^{40}} \approx 20,000Future Value=(1+0.04)40100,000≈20,000

These results illustrate how the purchasing power of Rs 100,000 will decrease significantly over time due to inflation.

Conclusion

The Future Value Inflation Calculator is a powerful tool for anyone looking to make informed financial decisions. By accounting for inflation, you can better understand how the value of your money will change over time and plan accordingly. Whether you’re investing, saving for retirement, or planning for future expenses, this calculator provides valuable insights that help you make smarter financial choices.

Start using the Future Value Inflation Calculator today to gain a clearer picture of your financial future and make more informed decisions about your money.

For any questions or additional support, feel free to contact our team or explore other resources on our website. Happy planning!

Understanding Future Value Inflation: How It Impacts Your Finances

In our ever-changing economic landscape, inflation is a term that frequently arises in discussions about financial planning and investment strategies. Understanding future value inflation is crucial for anyone looking to manage their finances effectively, whether for personal savings, retirement planning, or investment growth. In this blog post, we’ll explore what future value inflation is, how it impacts your finances, and strategies to manage its effects.

What is Future Value Inflation?

Future value inflation refers to the decrease in the purchasing power of money over time due to the general rise in prices. In other words, as inflation increases, the same amount of money will buy fewer goods and services in the future than it does today.

Inflation is typically measured as an annual percentage increase in the cost of goods and services. For example, if inflation is 3% per year, a product that costs Rs 100 today will cost Rs 103 next year. Over time, this incremental increase can significantly affect your financial planning and investment strategies.

How Future Value Inflation Affects Your Finances

- Purchasing Power Reduction: Inflation erodes the purchasing power of your money. This means that the value of savings or investments held today will be less in the future. For instance, if you save Rs 1,000 today, its value may only be equivalent to Rs 700 or Rs 800 in 20 years, depending on the inflation rate.

- Investment Returns: For investors, understanding inflation is crucial for assessing the real return on investments. An investment might offer a nominal return of 8% annually, but if inflation is 4%, the real return is only 4% (8% – 4%). Thus, your investments need to grow at a rate that outpaces inflation to maintain or increase their purchasing power.

- Retirement Planning: Inflation can significantly impact your retirement savings. As prices rise, the amount you need to cover living expenses in retirement increases. Effective retirement planning involves estimating future inflation rates and ensuring that your savings will be sufficient to maintain your desired standard of living.

- Savings Goals: When saving for large expenses, such as a home or education, inflation must be factored into your financial goals. The future cost of these expenses will be higher due to inflation, so it’s essential to save more to account for this increase.

Strategies to Manage Future Value Inflation

- Invest in Inflation-Protected Assets: Consider investing in assets that tend to perform well during inflationary periods. Real estate, commodities (like gold), and inflation-protected securities (such as Treasury Inflation-Protected Securities or TIPS) can help preserve your wealth.

- Diversify Your Investment Portfolio: Diversification can help manage risk and mitigate the effects of inflation. A well-diversified portfolio across different asset classes can help balance out the impact of inflation on your overall investments.

- Regularly Review and Adjust Your Financial Plan: Periodically review your financial plan and adjust your savings and investment strategies to keep pace with inflation. This may involve increasing your savings rate or reallocating your investment portfolio to better align with your long-term goals.

- Calculate Future Value Inflation: Use financial tools and calculators to estimate how inflation will impact your future savings and investments. This helps in planning and setting realistic financial goals. A Future Value Inflation Calculator can provide insights into how the purchasing power of your money will change over time.

Example of Future Value Inflation Impact

Let’s say you plan to save Rs 500,000 today for a major purchase in 20 years. If the annual inflation rate is 4%, the future cost of this purchase will be significantly higher. Using the future value inflation formula, you can estimate the equivalent value of your savings in today’s terms.

For example:

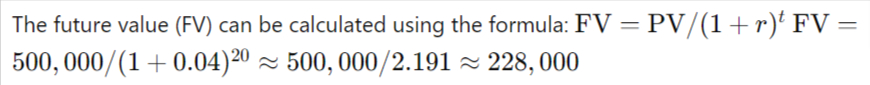

- Present Value (PV): Rs 500,000

- Inflation Rate (r): 4% or 0.04

- Number of Years (t): 20

The future value (FV) can be calculated using the formula: FV=PV/(1+r)t\text{FV} = \text{PV} / (1 + r)^tFV=PV/(1+r)t FV=500,000/(1+0.04)20≈500,000/2.191≈228,000\text{FV} = 500,000 / (1 + 0.04)^{20} \approx 500,000 / 2.191 \approx 228,000FV=500,000/(1+0.04)20≈500,000/2.191≈228,000

This means that Rs 500,000 today would have the purchasing power of approximately Rs 228,000 in 20 years if inflation averages 4% annually.

Conclusion

Future value inflation is a critical concept in financial planning that affects how you manage your money over time. By understanding its impact and incorporating strategies to counteract its effects, you can better protect your purchasing power and achieve your financial goals. Regularly reviewing your financial plan, investing wisely, and using tools like inflation calculators can help you stay ahead of inflation and ensure a more secure financial future.

If you have any questions or need assistance with financial planning, feel free to reach out to a financial advisor or explore resources available online. Stay informed, plan ahead, and make your money work for you in the long run!

Understanding Inflation and Its Impact on the Value of Money

It’s often said that change is the only constant in life, and this certainly applies to inflation and the value of money. Inflation causes the value of money to decrease over time, meaning that what you can buy today with a certain amount of money may not be the same in the future.

Why Knowing the Future Value of Money Matters

Understanding how inflation affects the future value of your money is essential for effective financial planning. High inflation means that the value of your money will decrease, so you’ll be able to buy less with the same amount in the future. Conversely, lower inflation allows your money to stretch further. Knowing how inflation impacts your savings helps ensure you can meet future needs and goals.

Historically, inflation in India peaked at 12% in 2010. It then decreased and stabilized around 4% from 2016 until 2019, which was within the Reserve Bank of India’s (RBI) target range. However, inflation surged past 6% following the pandemic and has recently fallen back below 4%.

Using an Inflation Calculator: What Will Rs 1 Lakh Be Worth in 20, 30, and 40 Years?

Let’s consider how inflation affects the future value of Rs 1 lakh using an annual inflation rate of 4%, which is close to the RBI’s target.

- After 20 Years: With a 4% annual inflation rate, Rs 1 lakh today would be worth approximately Rs 45638.69 in 20 years. This means that Rs 1 lakh today will have the purchasing power of about Rs 45,800 in two decades due to the compounding effect of inflation.

- After 30 Years: Extending the same 4% inflation rate, Rs 1 lakh will decrease to around Rs 30831.87 after 30 years. This illustrates how inflation continues to erode purchasing power over a longer period.

- After 40 Years: If inflation remains at 4% annually, Rs 1 lakh today will be worth roughly Rs 20828.90 in 40 years. This dramatic drop shows how inflation can significantly impact the future value of your money.

Conclusion

Understanding how inflation affects the future value of money is crucial for planning your finances effectively. As shown, the value of Rs 1 lakh today will diminish over time due to inflation — it will be about Rs 45638.69 after 20 years, Rs 30831.87 after 30 years, and just Rs 20828.90 after 40 years. This knowledge helps you make informed decisions about saving and investing to ensure your money maintains its value over the long term.

Disclaimer

Future Value Inflation Calculator

The Future Value Inflation Calculator provided on this website is a tool designed to assist users in estimating the future value of money considering inflationary effects. While the calculator uses standard formulas to project future values based on provided inputs, it is important to understand that the results are for informational purposes only and should not be considered financial advice.

Accuracy and Reliability:

- Data Accuracy: The calculator relies on the accuracy of the input data provided by users. Errors in input values may result in inaccurate calculations. Users should verify the data before making any financial decisions.

- Inflation Rate Assumptions: The calculator uses a constant inflation rate for projections. Actual future inflation rates may vary from the assumed rate, which can impact the accuracy of the results.

- No Financial Advice: The calculator does not take into account personal financial circumstances, goals, or other individual factors. It is not a substitute for professional financial advice. Users should consult with a qualified financial advisor or planner for personalized advice tailored to their specific situation.

Limitations:

- Future Variability: Economic conditions, inflation rates, and other factors can change over time, affecting the future value of money. The projections made by this calculator are based on current assumptions and may not accurately reflect future economic conditions.

- Responsibility: The website and its creators are not responsible for any financial decisions or actions taken based on the results provided by the calculator. Users are encouraged to use the calculator as a general guide and seek professional advice for important financial decisions.

Use of the Calculator:

By using the Future Value Inflation Calculator, you acknowledge that you have read and understood this disclaimer and agree that the website and its creators are not liable for any consequences arising from the use of the calculator.

Contact Information:

For questions or concerns regarding the calculator or its results, please contact us at info@calculatorkart.com.