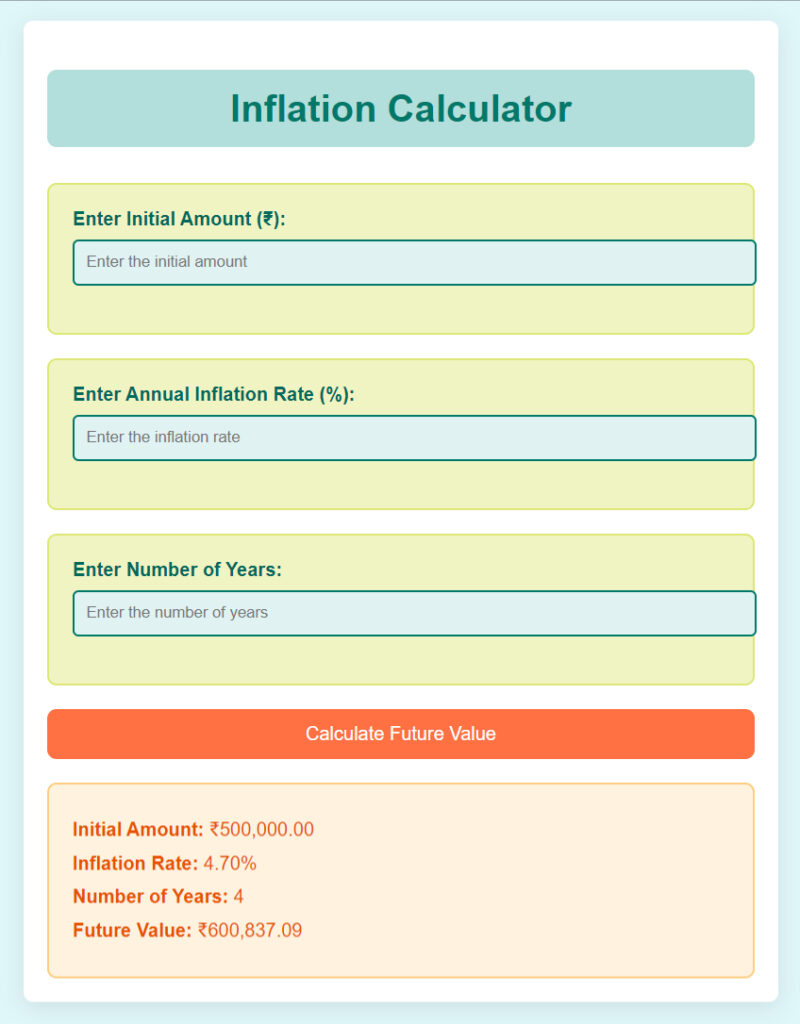

User Guide: How to Use Inflation Calculator

The Inflation Calculator allows users to calculate the future value of an initial amount of money considering an annual inflation rate over a specified number of years. This tool is particularly useful for financial planning and estimating the impact of inflation on savings or investments over time.

Features

- User-friendly interface: Simple, intuitive input fields for entering the initial amount, annual inflation rate, and the number of years.

- Dynamic result display: Shows the calculated future value immediately after the form is submitted.

- Responsive design: Works seamlessly on both desktop and mobile devices.

- Clear visual differentiation: Color-coded sections enhance user experience and readability.

Technology Stack

- HTML: Provides the structure and content of the webpage.

- CSS: Adds styling to the calculator, including colors, fonts, spacing, and responsive design elements.

- PHP: Handles form submissions and performs the future value calculation on the server side.

- JavaScript (optional): Can be used for additional client-side validation or dynamic calculations if needed.

Input Fields

- Initial Amount (₹):

- Description: The initial amount of money or investment.

- Type: Number

- Validation: Must be a non-negative number.

- Annual Inflation Rate (%):

- Description: The average annual inflation rate, typically expressed as a percentage.

- Type: Number

- Validation: Must be a non-negative number. Can include decimal values.

- Number of Years:

- Description: The number of years over which inflation will be applied.

- Type: Number

- Validation: Must be an integer greater than or equal to 1.

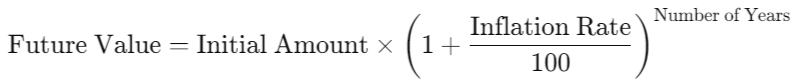

Calculation Formula

The formula used to calculate the future value is:

Future Value=Initial Amount×(1+Inflation Rate100)Number of Years\text{Future Value} = \text{Initial Amount} \times \left(1 + \frac{\text{Inflation Rate}}{100}\right)^{\text{Number of Years}}Future Value=Initial Amount×(1+100Inflation Rate)Number of Years

Where:

- Initial Amount is the starting value of money.

- Inflation Rate is the annual percentage increase in prices.

- Number of Years is the duration over which inflation is applied.

How to Use

- Enter Initial Amount: Input the initial amount in rupees.

- Enter Inflation Rate: Specify the annual inflation rate as a percentage (e.g., 5.5 for 5.5%).

- Enter Number of Years: Input the number of years you wish to calculate for.

- Submit: Click the “Calculate Future Value” button to get the future value of the initial amount after the specified period.

- View Results: The results section will display the future value along with the breakdown of the inputs.

Results

After submitting the form, the calculator will display:

- Initial Amount: The amount you originally input.

- Inflation Rate: The rate of inflation used for calculation.

- Number of Years: The period over which inflation is calculated.

- Future Value: The value of the initial amount adjusted for inflation after the specified number of years.

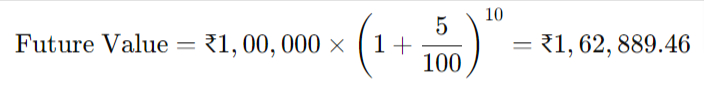

Example

If you input the following values:

- Initial Amount: ₹1,00,000

- Annual Inflation Rate: 5%

- Number of Years: 10

The calculator will display the future value, which is the amount of ₹1,62,889.46 after 10 years.

User Interface (UI) Enhancements

The interface is designed to be clean, colorful, and visually appealing. The key elements include:

- Container Styling: A white background with rounded corners and shadow effects makes the form stand out.

- Color-Coded Sections: The input sections are differentiated by distinct colors (light green, light yellow) to enhance usability.

- Button Styling: The submit button is styled with a bright orange color to grab attention, with a hover effect for interactivity.

- Responsive Layout: The calculator is designed to be accessible on both desktop and mobile devices.

Optional Enhancements

While the current calculator is basic and server-side driven, additional features could include:

- Client-side validation: JavaScript validation to check for valid inputs before submission.

- Dynamic calculations: Using JavaScript to show the result without reloading the page.

- Historical inflation data: Add an option to automatically populate the inflation rate based on historical data.

Conclusion

This Inflation Calculator is a simple yet effective tool for calculating the impact of inflation on an initial sum of money. With its clean design and user-friendly interface, it offers a great user experience for individuals seeking to understand how inflation will affect their savings over time.

Understanding Inflation and Its Impact with an Inflation Calculator

Inflation is a critical economic factor that affects the purchasing power of money over time. As prices increase due to inflation, the value of your money decreases, making it essential to plan for the future. But how can you calculate exactly how much inflation will affect your savings or investments over a specific period? Enter the Inflation Calculator — a simple yet powerful tool designed to give you an estimate of the future value of your money, considering inflation.

What is Inflation?

Inflation refers to the general rise in prices of goods and services over time. As prices increase, each unit of currency buys fewer goods and services, reducing the purchasing power of money. For example, something that costs ₹1,000 today may cost ₹1,500 after ten years if the inflation rate is 5%.

While inflation is a natural part of any economy, it can erode your savings and investments if you don’t plan accordingly. This is where an Inflation Calculator becomes a crucial tool.

How Does the Inflation Calculator Work?

The Inflation Calculator helps you calculate the future value of an initial amount of money, factoring in the annual inflation rate and the number of years you want to account for. By entering three simple inputs — initial amount, inflation rate, and number of years — you can easily estimate how much your money will be worth in the future.

Inputs Required:

- Initial Amount (₹): The amount of money you are starting with, such as savings or investments.

- Annual Inflation Rate (%): The rate at which you expect prices to rise each year. This can vary depending on economic conditions.

- Number of Years: The time period over which you want to calculate the future value, typically in years.

Formula for Future Value:

The formula used to calculate the future value is:

Future Value=Initial Amount×(1+Inflation Rate100)Number of Years\text{Future Value} = \text{Initial Amount} \times \left(1 + \frac{\text{Inflation Rate}}{100}\right)^{\text{Number of Years}}Future Value=Initial Amount×(1+100Inflation Rate)Number of Years

Using this formula, the calculator provides you with the future value of your money after accounting for inflation.

Why Use an Inflation Calculator?

Inflation calculators are essential for individuals who want to plan their financial future. Here are some key reasons to use one:

- Financial Planning: When saving for retirement, buying a house, or investing for your child’s education, inflation can significantly affect your plans. An inflation calculator gives you an accurate idea of how much you’ll need in the future.

- Comparing Investment Returns: It helps compare the actual return on your investments by adjusting for inflation. For instance, a 7% return may sound great, but if inflation is 5%, your real return is only 2%.

- Setting Realistic Goals: Understanding the future value of your money allows you to set realistic savings and investment goals. It ensures you’re not underestimating the amount you need for your future expenses.

Example: How Much Will ₹1,00,000 Be Worth After 10 Years?

Let’s say you want to calculate the future value of ₹1,00,000 with an annual inflation rate of 5% over the next 10 years. Using the Inflation Calculator, you’ll find that the future value is:

Future Value=₹1,00,000×(1+5100)10=₹1,62,889.46\text{Future Value} = ₹1,00,000 \times \left(1 + \frac{5}{100}\right)^{10} = ₹1,62,889.46Future Value=₹1,00,000×(1+1005)10=₹1,62,889.46

This means your ₹1,00,000 today will have the same purchasing power as ₹1,62,889.46 in ten years if inflation remains at 5%.

Key Benefits of the Inflation Calculator

- Simple and Quick: It only requires basic inputs and provides results in seconds.

- Accurate Estimates: The calculator uses the standard inflation formula to give you an accurate future value of your money.

- Financial Awareness: It promotes better financial awareness by showing how much inflation can impact your savings or investments.

How to Use the Inflation Calculator

Using the Inflation Calculator is easy:

- Enter the initial amount (e.g., ₹50,000).

- Input the expected annual inflation rate (e.g., 6%).

- Enter the number of years (e.g., 15).

- Click “Calculate” to see the future value of your money.

The result will show you how much ₹50,000 will be worth in 15 years, helping you make better financial decisions.

Conclusion

Inflation may be an inevitable part of life, but with the right tools, you can manage its impact on your savings and investments. The Inflation Calculator is an essential tool that helps you understand how inflation will affect your money over time. Whether you’re saving for the future, investing, or planning for retirement, this calculator ensures you’re better prepared for the financial challenges ahead.

Start planning your financial future today with our Inflation Calculator and stay one step ahead of inflation!

What is Inflation and How Does it Impact Your Financial Future?

Inflation is one of the most important concepts in economics, and it affects almost everyone, whether they realize it or not. From the rising cost of groceries to the increasing price of fuel, inflation can influence nearly every aspect of your financial life. But what exactly is inflation, and how can it impact your long-term financial planning?

What is inflation in simple words?

Inflation refers to the general rise in prices of goods and services over time, leading to a decrease in the purchasing power of money. In simpler terms, inflation means that you need more money to buy the same goods and services as time goes by.

For example, a cup of coffee that costs ₹50 today may cost ₹55 next year if inflation is 10%. While 5 extra rupees may not seem significant on a small purchase, the cumulative effect of inflation across all aspects of life can make a substantial difference over the years.

Types of Inflation

There are several types of inflation, categorized by the cause behind the price increase. Understanding the different types can give you a clearer picture of why inflation occurs.

- Demand-Pull Inflation: This happens when the demand for goods and services exceeds their supply. When more people want a product than there is available, businesses raise prices, leading to inflation.

- Cost-Push Inflation: This occurs when the production cost of goods and services rises, leading businesses to increase their prices to maintain profitability. For example, an increase in raw material prices or wages can cause cost-push inflation.

- Built-In Inflation: This is often referred to as the wage-price spiral, where workers demand higher wages to keep up with rising living costs. Businesses, in turn, raise prices to cover higher labor costs, creating a cycle of inflation.

Measuring Inflation

Inflation is commonly measured using price indices that track the cost of a basket of goods and services over time. The two main indices used to measure inflation are:

- Consumer Price Index (CPI): This index measures the average price change over time that consumers pay for goods and services. It includes everyday items like food, clothing, transportation, and healthcare.

- Wholesale Price Index (WPI): This measures the price changes in goods before they reach consumers, such as raw materials and bulk purchases.

In India, the CPI is the most widely used measure of inflation, and it plays a critical role in economic policy decisions, including adjustments to interest rates.

How Does Inflation Affect You?

Inflation can have both positive and negative effects on individuals, businesses, and the economy. Let’s look at some of the key ways inflation impacts your life.

1. Reduced Purchasing Power

The most immediate impact of inflation is that your money loses value over time. For example, if inflation is 5%, then ₹1,000 today will only have the purchasing power of ₹950 next year. As prices rise, you’ll need more money to maintain your standard of living.

2. Savings and Investments

Inflation can erode the value of your savings if the interest you earn on savings accounts or fixed deposits does not keep pace with the inflation rate. This means your money may be growing, but its real value could be declining. This is why it’s crucial to invest in inflation-beating assets like stocks, real estate, or inflation-indexed bonds.

3. Interest Rates

Inflation affects interest rates set by central banks. If inflation rises too quickly, central banks like the Reserve Bank of India (RBI) may increase interest rates to control inflation. Higher interest rates can make borrowing more expensive, affecting loans for homes, cars, and businesses.

4. Wages

In a high-inflation environment, wages may not rise as fast as the cost of living, leading to a decline in real income. However, in some cases, inflation can lead to higher wages, especially if workers demand pay increases to keep up with rising prices.

Inflation and Long-Term Financial Planning

Inflation is particularly important when planning for long-term financial goals, such as retirement, purchasing a home, or saving for education. Over time, inflation can significantly reduce the real value of your money if you’re not accounting for it in your financial plans.

Here are some strategies to protect your financial future from inflation:

1. Invest in Inflation-Protected Assets

Certain assets are more resistant to inflation than others. For example, investing in stocks, real estate, or commodities can often provide better returns that outpace inflation. Additionally, inflation-indexed bonds like Inflation-Linked Government Securities (ILGS) adjust with inflation, ensuring your purchasing power is protected.

2. Diversify Your Portfolio

A diversified portfolio with a mix of equities, bonds, and real assets can help you mitigate the risk of inflation eroding your savings. While equities tend to perform well in inflationary periods, holding assets across different sectors ensures that you’re better protected against volatility.

3. Regularly Adjust Your Financial Goals

As inflation changes, it’s important to periodically review and adjust your financial goals. For instance, if you’re saving for retirement, make sure your savings plan takes inflation into account, so you don’t fall short when you need the money.

4. Use Inflation Calculators

An Inflation Calculator is a handy tool that helps you understand how much your money will be worth in the future, considering the inflation rate. By estimating the future value of your savings or investments, you can adjust your financial plans accordingly.

Try More Calculators:

- Future Value Inflation Calculator

- Income Tax Calculator

- Advanced Income Tax Calculator

- Salary Breakdown Calculator

- Net Salary Calculator

Conclusion

Inflation is a critical factor in economic and financial planning, impacting everything from your daily expenses to your long-term savings. While you can’t avoid inflation, you can prepare for it by investing in inflation-resistant assets, adjusting your financial goals, and using tools like inflation calculators to make informed decisions.

By staying informed about inflation and its potential impacts, you can safeguard your financial future and ensure that your savings and investments maintain their value over time.

Disclaimer

The information provided in this blog post is for general informational and educational purposes only. While we strive to keep the content accurate and up-to-date, we make no warranties of any kind, express or implied, regarding the accuracy, completeness, reliability, or suitability of the information provided.

The inflation calculator and financial strategies discussed are tools to help you understand and estimate the effects of inflation, but they should not be considered as financial, investment, or professional advice. Individual financial situations vary, and it is important to consult with a qualified financial advisor or professional before making any investment, savings, or financial decisions based on inflation predictions or calculators.

We are not responsible for any financial losses or other damages that may arise from using the information provided in this blog post. Use of the calculator and information is at your own risk. Always do your own research and seek advice from professionals to ensure you are making informed financial decisions.