GST Calculator Documentation

The GST Calculator is a web-based tool that allows users to calculate Goods and Services Tax (GST) for any product or service. It helps users calculate both GST-inclusive and GST-exclusive prices based on the input amount and GST percentage. The calculator supports standard GST slabs of 5%, 12%, 18%, and 28%, as well as a custom GST rate option.

Features

- GST Inclusion and Exclusion: Calculates both GST-inclusive and GST-exclusive prices.

- Standard GST Slabs: Supports 5%, 12%, 18%, and 28% GST rates.

- Custom GST Rate: Allows users to input a custom GST rate.

- Real-Time Calculation: Results are displayed instantly after form submission.

- User-Friendly Interface: Clean and responsive UI for ease of use.

Technology Stack

- Frontend: HTML5, CSS3, JavaScript

- Backend: PHP (for server-side form handling if needed)

- Browser Compatibility: Works on modern browsers like Chrome, Firefox, Safari, and Edge.

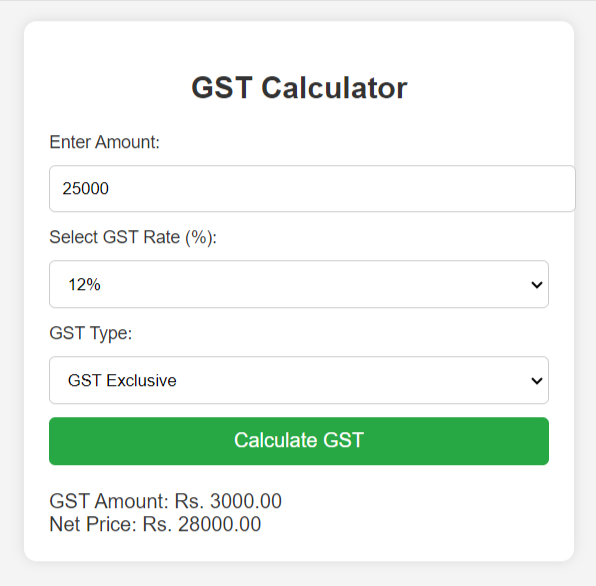

How to Use the GST Calculator

- Open the GST Calculator in your browser.

- Enter the amount: The base price of the product or service.

- Select the GST Rate: Choose one of the predefined GST slabs (5%, 12%, 18%, 28%) or select “Other” to enter a custom GST percentage.

- Choose the GST Type:

- GST Inclusive: Calculate the original cost that includes GST.

- GST Exclusive: Add the GST amount to the base cost.

- Click “Calculate” to view the results. The calculator will display:

- The GST amount.

- The final cost (either inclusive or exclusive of GST).

Calculation Logic

GST Inclusion

To calculate the GST amount when it’s already included in the price:

GST Amount = Amount - (Amount * (100 / (100 + GST Rate)))

Net Price = AmountGST Exclusion

To calculate the GST amount and the total cost when GST needs to be added:

GST Amount = (Amount * GST Rate) / 100

Net Price = Amount + GST AmountCustomization

Modifying GST Slabs

- You can add or remove GST slab options by modifying the <select> element in the HTML form:

<select id="gstRate" name="gstRate">

<option value="5">5%</option>

<option value="12">12%</option>

<option value="18">18%</option>

<option value="28">28%</option>

<option value="other">Other</option>

</select>Custom Styles

- You can adjust the appearance of the calculator by modifying the CSS styles in the <style> block or by linking to an external CSS file.

Additional Functionalities

- You can integrate more complex tax rules or add validation rules by modifying the JavaScript logic in the <script> block.

Known Issues

- Decimal Precision: The current implementation rounds the results to two decimal places. This could lead to very minor inaccuracies in cases of high-precision calculations.

- Custom GST Rate Validation: The tool currently assumes the user will input a valid GST rate when selecting “Other”. Additional validation might be needed for edge cases.

Future Enhancements

- Enhanced Validation: Add more robust input validation, especially for custom GST rates.

- Currency Support: Allow the calculator to support different currencies (₹, $, €, etc.).

- Mobile Responsiveness: Further optimize the design for mobile devices.

Conclusion

This GST Calculator is an easy-to-use tool designed to simplify the process of calculating GST. By implementing both GST-inclusive and GST-exclusive calculations, it provides flexibility for different user requirements. The tool’s modular design also allows easy future enhancements and customization.

This documentation provides a detailed guide on how to use, modify, and customize the GST Calculator. It’s designed to be accessible to both non-technical users and developers looking to enhance its functionality.

Try More Calculators:

- Inflation Calculator

- Future Value Inflation Calculator

- Income Tax Calculator

- Advanced Income Tax Calculator

- Salary Breakdown Calculator

Simplify Your Tax Calculations with a GST Calculator

In India, the Goods and Services Tax (GST) has transformed the way businesses and individuals manage their taxes. With varying GST rates applied across products and services, it can be challenging to manually calculate the tax amount. This is where a GST Calculator comes to the rescue. Whether you’re a business owner, an accountant, or a consumer, understanding how much tax you are paying is essential. A GST calculator simplifies this task by providing quick and accurate calculations, helping you save time and avoid errors.

What is a GST Calculator?

A GST Calculator is a simple online tool that helps you compute the Goods and Services Tax (GST) you need to pay on any product or service. By inputting the original price and selecting the applicable GST rate, the calculator instantly provides you with the GST amount and the total cost (inclusive or exclusive of GST). This tool eliminates the need for manual tax computations, ensuring accuracy and transparency.

Why Use a GST Calculator?

A GST calculator is more than just a tool for quick calculations. It offers several benefits that can improve your financial awareness and simplify business transactions:

- Accurate GST Calculations: Manual tax calculations are prone to errors, especially with varying GST rates. The calculator ensures precision in computing the GST amount.

- Saves Time: Instead of manually calculating tax for each transaction, a GST calculator does the job instantly, allowing you to focus on other important tasks.

- Transparency: As a consumer, knowing how much GST you are paying can prevent potential overcharging. As a business owner, it helps in maintaining transparent records for tax filings.

- Simplifies GST Inclusive/Exclusive Calculations: The tool lets you easily switch between GST-inclusive and GST-exclusive pricing, making it easier to adjust product prices or determine the pre-tax amount.

How Does the GST Calculator Work?

The GST Calculator uses standardized formulas to compute the tax. It supports both GST inclusive and GST exclusive amounts:

- GST Inclusive: This means the GST is already included in the total price. The calculator helps you figure out how much of the price is allocated to the tax.

- GST Exclusive: This is the original price before GST is added. The calculator helps you add the appropriate tax based on the selected GST rate.

GST Calculation Formulas

Here are the formulas used to calculate GST:

1. Adding GST to a base price:

GST Amount = (Original Cost * GST Rate) / 100

Net Price = Original Cost + GST Amount2. Removing GST from an inclusive price:

GST Amount = Amount - (Amount * (100 / (100 + GST Rate)))

Net Price = AmountFor example, if a product costs ₹1000 and the applicable GST rate is 18%, the GST amount would be:

GST Amount = (1000 * 18) / 100 = ₹180

Net Price = ₹1000 + ₹180 = ₹1180Conversely, if the price is ₹1180 inclusive of 18% GST, the original price without GST can be calculated as:

GST Amount = 1180 - (1180 * (100 / 118)) = ₹180

Net Price = ₹1000GST Tax Slabs in India

In India, GST rates vary depending on the category of goods and services. The different tax slabs include:

- 5% GST

- 12% GST

- 18% GST

- 28% GST

For some products, custom GST rates can apply, and the GST Calculator can handle these variations by offering an option to enter a custom GST rate.

How to Use the GST Calculator

Using the GST calculator is simple and straightforward. Here’s how you can do it:

- Enter the Amount: Input the original price of the product or service.

- Select the GST Rate: Choose from predefined slabs (5%, 12%, 18%, 28%), or enter a custom rate if needed.

- Choose GST Inclusive/Exclusive: Select whether the price includes GST or needs GST added.

- Click on Calculate: The calculator will display the GST amount and the net price in a matter of seconds.

GST Calculator: A Must-Have Tool for Businesses and Consumers

For businesses, accurate tax calculations are crucial for maintaining transparent financial records and ensuring compliance with tax laws. A GST Calculator simplifies this process by eliminating the guesswork, helping businesses compute their GST liabilities with ease.

Consumers can also benefit from a GST calculator. It allows them to verify the GST charged on their purchases, preventing any overcharging or fraudulent activities. By understanding the exact tax they are paying, consumers can become more informed and financially aware.

Conclusion

With the complexity of GST in India, a GST Calculator is an invaluable tool that helps you manage your finances better. Whether you are calculating the GST on a product or determining the pre-tax amount, this tool simplifies tax calculations, ensures accuracy, and saves valuable time. In a few clicks, you can stay informed and confident about the taxes you are paying, making it easier to navigate the world of GST.

Don’t waste time with manual calculations—use a GST Calculator today and ensure your tax calculations are accurate and hassle-free!

Feel free to add this GST Calculator to your website to enhance user experience and simplify tax calculations for your visitors.

Understanding GST: A Comprehensive Guide to India’s Goods and Services Tax

In 2017, India underwent a significant shift in its taxation system with the introduction of the Goods and Services Tax (GST). Designed as a single, unified tax, GST replaced numerous indirect taxes that were previously levied by both the central and state governments. Whether you’re a consumer, a business owner, or an accounting professional, understanding GST is crucial for navigating the complexities of taxation in India.

This blog aims to provide a comprehensive guide to GST, its impact, benefits, tax slabs, and how it simplifies the taxation process.

What is GST?

GST is a value-added tax applied to the supply of goods and services. It is a destination-based tax, meaning it is collected at the point of consumption rather than the point of origin. This unified tax structure simplifies the tax system by combining various indirect taxes such as excise duty, VAT, service tax, and others into a single tax, making the entire process more transparent and efficient.

Key Components of GST

GST is divided into several key components to ensure fair distribution of tax revenue between the central and state governments:

- CGST (Central Goods and Services Tax): Collected by the central government on intra-state transactions (within the same state).

- SGST (State Goods and Services Tax): Collected by the state government on intra-state transactions.

- IGST (Integrated Goods and Services Tax): Collected by the central government on inter-state transactions (between two different states).

- UTGST (Union Territory Goods and Services Tax): Applied to transactions in Union Territories.

Why was GST Introduced?

Before the implementation of GST, India’s indirect tax system was fragmented, with different taxes applied at various stages of the production and supply chain. Multiple taxes, such as VAT, excise duty, and service tax, often led to tax duplication or “tax on tax,” which increased the cost for businesses and consumers. The primary objectives of GST were to:

- Simplify the tax structure by consolidating various taxes into a single tax.

- Eliminate tax cascading, ensuring that the tax paid on inputs can be set off against the tax liability on outputs.

- Boost compliance through digital platforms for registration, filing returns, and payment of taxes.

- Increase transparency in the taxation process, reducing the scope for tax evasion and fraud.

GST Tax Slabs in India

India’s GST system has four primary tax slabs to categorize goods and services:

- 5% GST: Applicable on essential items such as basic food products and agricultural goods.

- 12% GST: Applied to processed food products, basic electronics, and other consumer goods.

- 18% GST: One of the most common rates, covering items such as smartphones, telecom services, banking services, and more.

- 28% GST: The highest slab, which includes luxury items like cars, high-end consumer goods, and premium products.

Additionally, certain goods such as alcohol, petroleum products, and electricity are exempt from GST and continue to be taxed by individual states.

How Does GST Work?

GST operates on a value-added principle, which means tax is levied at every stage of production or service delivery, but the tax burden ultimately falls on the end consumer. Here’s how it works:

- Input Tax Credit (ITC): Under GST, businesses can claim a credit for the tax paid on purchases (input tax). This ensures that businesses are taxed only on the value they add at each stage of the supply chain.

For example, if a manufacturer pays ₹100 as GST on raw materials and collects ₹150 as GST on the final product, they can claim a credit of ₹100. This way, the manufacturer only needs to pay ₹50 as tax.

- GST Payment & Filing: Businesses are required to file monthly, quarterly, or annual GST returns, depending on their turnover. The filing process is streamlined through the GSTN portal, where all transactions and tax credits are recorded digitally.

Benefits of GST

The introduction of GST has brought numerous benefits for businesses, consumers, and the overall economy:

- Unified Tax Structure: GST has replaced a myriad of taxes, creating a single, nationwide tax system that’s easier to understand and comply with.

- Reduced Tax Burden on Consumers: By eliminating the cascading effect of taxes, GST has helped reduce the overall tax burden on consumers.

- Increased Transparency: The entire GST process is automated and transparent, reducing the chances of tax evasion and fraud. Every transaction is recorded digitally, making it easier for the government to track tax liabilities.

- Boost to Economic Growth: By simplifying the tax structure, GST has made it easier for businesses to operate across state lines, fostering economic integration and encouraging growth.

- Encouraging Compliance: The digitized GST platform has made it easier for businesses to register, file returns, and pay taxes, thus encouraging more compliance across industries.

Challenges with GST

While GST has largely been a positive reform, there have been some challenges:

- Compliance Burden: Small businesses, in particular, have faced challenges with the filing of multiple GST returns and the complexity of input tax credit.

- Technical Issues: The GSTN portal, especially in its early days, suffered from technical glitches and server slowdowns, which complicated the filing process for many businesses.

- Multiple Rate Structure: Though GST has simplified taxation, the multiple rate slabs can still lead to confusion, especially when classifying goods and services that fall under different categories.

- Lack of Awareness: In the initial years, businesses and consumers faced a lack of awareness about how GST worked, leading to delays in implementation and occasional misclassification of taxes.

Conclusion

The introduction of GST in India has been a monumental shift in the country’s tax landscape. By consolidating multiple taxes into a single, unified system, GST has made it easier for businesses to operate, reduced the burden on consumers, and increased transparency in the taxation process. While there are challenges, the benefits of GST far outweigh the drawbacks, and with continued improvements in compliance and technology, GST will continue to evolve into an even more efficient system.

Whether you’re a business owner calculating your tax liabilities or a consumer understanding the tax on your purchases, GST is here to stay. A clear understanding of how it works can help you navigate the complexities of India’s tax system with ease.

For those who need help calculating GST for their business or purchases, there are many online GST Calculators available that can help you quickly and accurately compute the tax.

Disclaimer

The information provided on this blog is for general informational purposes only and is not intended as professional tax, legal, or financial advice. While we strive to provide accurate and up-to-date content regarding the Goods and Services Tax (GST) and related topics, we make no warranties or guarantees about the completeness, accuracy, or reliability of the information presented.

Readers are encouraged to consult with qualified professionals, such as accountants or tax advisors, to obtain specific advice tailored to their individual circumstances. The use of any information from this blog is solely at your own risk.

We are not responsible for any losses, damages, or liabilities that may arise directly or indirectly from the use of the information contained on this blog. Furthermore, the GST laws and rates may change over time, so it is advisable to verify current laws and rates from official government resources or consult a professional for the most up-to-date information.

By using this blog, you agree to this disclaimer and acknowledge that you should perform your own research and seek appropriate professional guidance when needed.