Use our simple Salary Structure Calculator to find out your ideal salary. Get accurate results fast and take charge of your earning potential!

User Guide: How to Use Salary Structure Calculator

Need to understand your salary better? Our Salary Structure Calculator helps you make informed decisions. Start calculating your salary today!

The Salary Structure Calculator is a web-based tool designed to calculate the detailed salary structure of an employee based on the provided CTC (Cost to Company). The tool breaks down the salary into various components like Basic Salary, Dearness Allowance (DA), House Rent Allowance (HRA), and other allowances, while also calculating deductions such as TDS, EPF, and professional tax. The final output includes the net salary after all deductions.

Code Explanation

HTML Structure:

- The form has a single input field where the user can input the CTC (Cost to Company).

- The form uses the POST method to submit the CTC to the server.

PHP Processing:

Upon form submission, PHP processes the input CTC and calculates various components of the salary structure:

- Basic Salary: 40% of CTC.

- DA (Dearness Allowance): 55% of the basic salary.

- HRA (House Rent Allowance): 50% of the basic salary.

- Health Insurance: Approximately 11.8233% of the CTC.

- Total Allowances: Sum of HRA, medical, transport allowance, LTA, and special allowance.

- Gross Salary: Sum of the basic salary and total allowances.

- TDS (Tax Deducted at Source): 10% of the gross salary.

- EPF (Employee Provident Fund): 12% of the sum of the basic salary and DA.

- Professional Tax: Fixed at ₹2400 annually.

- Total Deductions: Sum of professional tax, TDS, and EPF.

- Net Salary: Gross salary minus total deductions.

JavaScript:

The script ensures that the CTC value entered is not negative.

How to Use Code

- Save this combined PHP + HTML + JavaScript code in a .php file (e.g., Salary Structure Calculator).

- Place it on a server with PHP support.

- Open the file in a browser to use the Salary Structure Calculator.

Results

This calculator provides a comprehensive breakdown of the salary structure based on the input CTC.

How to Use Salary Structure Calculator

Find your worth with our easy Salary Structure Calculator. Get accurate salary estimates and empower your career choices—use it now!

Using the Salary Structure Calculator

Calculate your salary structure in minutes! Our user-friendly tool gives you quick insights into your earnings—try it today and plan for success!

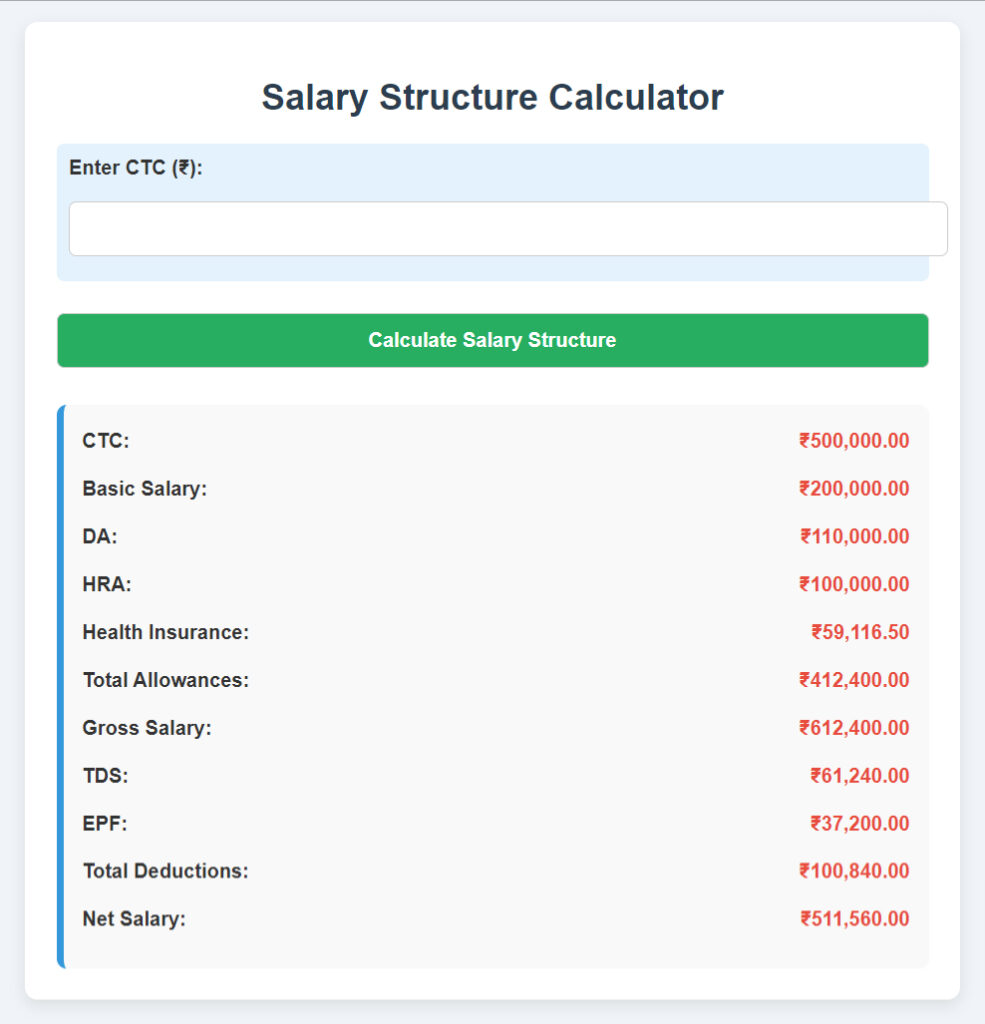

Step 1. Open the Web Page:

- Navigate to the URL where the Salary Structure Calculator is hosted.

Step 2. Enter CTC:

- Enter the employee’s CTC (Cost to Company) in the input field labeled “Enter CTC (₹)”.

Step 3. Submit the Form:

- Click on the “Calculate Salary Structure” button to process the CTC and calculate the salary structure.

Step 4. View the Results:

After submitting the form, the page will display a detailed breakdown of the salary structure:

- Basic Salary: 40% of the CTC.

- Dearness Allowance (DA): 55% of the Basic Salary.

- House Rent Allowance (HRA): 50% of the Basic Salary.

- Health Insurance: Approximately 11.8233% of the CTC.

- Total Allowances: Includes HRA, Medical, Transport Allowance, LTA, and Special Allowance.

- Gross Salary: Sum of Basic Salary and Total Allowances.

- TDS (Tax Deducted at Source): 10% of the Gross Salary.

- EPF (Employee Provident Fund): 12% of the sum of Basic Salary and DA.

- Professional Tax: Fixed at ₹2400 per year.

- Total Deductions: Sum of Professional Tax, TDS, and EPF.

- Net Salary: Gross Salary minus Total Deductions.

Example Scenario

- CTC Entered: ₹15,00,000

- Output:

- Basic Salary: ₹5,99,200

- DA: ₹3,29,560

- HRA: ₹2,99,600

- Health Insurance: ₹1,77,348.8

- Total Allowances: ₹6,12,000

- Gross Salary: ₹12,11,200

- TDS: ₹1,21,120

- EPF: ₹1,11,451.2

- Total Deductions: ₹2,34,971.2

- Net Salary: ₹9,76,228.8

Troubleshooting

- Form Not Submitting: Ensure the web server has PHP enabled and the file permissions are correctly set.

- Negative Values: The input field ensures no negative CTC values are entered. If the field doesn’t respond as expected, check the JavaScript is properly loading.

Customization

- Adjust Percentage Values: If your company follows a different percentage for any salary component (e.g., Basic Salary or HRA), you can edit the PHP calculations accordingly within the file.

- Add/Remove Components: Additional salary components can be added, or existing ones can be removed, by modifying the PHP script and adjusting the calculations.

Support

For further assistance with Salary Structure Calculator, you can contact the developer or refer to online PHP and HTML resources for additional guidance on customization and deployment.

How to Use Guide for Salary Structure Calculator

The Salary Structure Calculator is a simple web tool that allows you to calculate the salary structure based on the provided Cost to Company (CTC). This guide will walk you through the steps to use the tool effectively.

Steps to Use Salary Structure Calculator

Step 1. Open the Calculator:

- Launch your web browser (e.g., Chrome, Firefox).

- In the address bar, type the URL where the Salary Structure Calculator is hosted. For example: https://calculatorkart.com/salary-structure-calculator.php.

Step 2. Enter the CTC:

- Once the page loads, you’ll see a form with a single input field labeled “Enter CTC (₹)”.

- In this field, input the total CTC amount in Indian Rupees. Make sure to enter a positive value. For example, if your CTC is ₹15,00,000, enter 1500000.

Step 3. Submit the Form:

- After entering the CTC, click on the “Calculate Salary Structure” button.

- This will submit the form and process the calculation based on the provided CTC.

Step 4. View the Results:

After submission, the page will display a detailed salary breakdown including:

- Basic Salary: The basic component of your salary, calculated as 40% of the CTC.

- DA (Dearness Allowance): Calculated as 55% of the Basic Salary.

- HRA (House Rent Allowance): Calculated as 50% of the Basic Salary.

- Health Insurance: Fixed percentage (11.8233%) of CTC allocated for health insurance.

- Total Allowances: Sum of all other allowances (HRA, Medical, Transport, LTA, Special Allowance).

- Gross Salary: The sum of Basic Salary and Total Allowances.

- TDS (Tax Deducted at Source): Calculated as 10% of the Gross Salary.

- EPF (Employee Provident Fund): 12% of the sum of Basic Salary and DA.

- Professional Tax: Fixed annual deduction.

- Total Deductions: The sum of all deductions (Professional Tax, TDS, EPF).

- Net Salary: Your take-home salary after all deductions.

Step 5. Analyze Your Salary:

- Use the detailed breakdown to understand how your CTC is distributed across different salary components and deductions.

- This can help you plan your finances better by knowing your net salary and the contributions made to various funds like EPF.

Example Walkthrough

- CTC Input: Suppose you enter a CTC of ₹15,00,000.

- Click Calculate: After entering, you press the “Calculate Salary Structure” button.

- View Output: The page will show:

- Basic Salary: ₹5,99,200

- DA: ₹3,29,560

- HRA: ₹2,99,600

- Health Insurance: ₹1,77,348.8

- Total Allowances: ₹6,12,000

- Gross Salary: ₹12,11,200

- TDS: ₹1,21,120

- EPF: ₹1,11,451.2

- Total Deductions: ₹2,34,971.2

- Net Salary: ₹9,76,228.8

This detailed breakdown will help you understand how your salary is structured and what your net salary will be.

Tips

- Ensure Correct CTC Entry: Always double-check the CTC amount you enter to ensure the calculations are accurate.

- Use for Planning: Use the output to plan your savings, investments, and expenses based on your net salary.

Need Help?

If you encounter any issues or need further assistance, please contact the website administrator or consult a web developer for technical support.

This guide should help you effectively use the Salary Structure Calculator to get an accurate breakdown of your salary components.

Try More Calculators:

- TDS Calculator

- GST Calculator

- Inflation Calculator

- Future Value Inflation Calculator

- Income Tax Calculator

Understanding Salary Structure Calculator: A Guide to Simplifying Payroll Calculations

In today’s fast-paced professional environment, understanding your salary structure is crucial for effective financial planning. Whether you’re an employer managing payroll or an employee looking to decode your pay, a Salary Structure Calculator simplifies the entire process. This calculator offers a user-friendly solution for determining various components of your salary, from basic pay to deductions and allowances. In this blog, we’ll break down what a salary structure is, why you need a salary structure calculator, and how it works.

What is Salary Structure?

A salary structure refers to the detailed breakdown of an employee’s compensation, which includes several components beyond just the basic salary. Here are the key components typically included in a salary structure:

- Basic Salary: The core component of your salary, generally 40%-50% of your total salary. It’s fully taxable.

- House Rent Allowance (HRA): Provided for rental expenses; tax exemptions apply if you’re renting a home.

- Conveyance Allowance: An allowance for transportation costs, which also has a tax exemption up to a certain limit.

- Medical Allowance: This covers medical expenses incurred by the employee.

- Special Allowance: This makes up the remaining part of your salary after other allowances and deductions.

- Provident Fund (PF) Contribution: A portion of your salary (usually 12% of basic pay) that is contributed to your PF account.

- Professional Tax: A state-level tax deducted from your salary, with different rates depending on your state.

- Bonus: A fixed or variable additional payment offered by the company.

- Income Tax Deductions: Depending on the tax regime chosen, income tax is deducted from your salary based on applicable slabs.

Why Use a Salary Structure Calculator?

Whether you’re an employer structuring compensation packages or an employee trying to understand your payslip, a Salary Structure Calculator offers numerous advantages:

- Accuracy: Manual calculations can often lead to errors. The calculator ensures that all components, deductions, and contributions are factored in accurately.

- Time-Saving: Instead of performing complex calculations by hand, a salary structure calculator does the work in seconds, allowing you to focus on more critical tasks.

- Transparency: It provides transparency by clearly showing how much of your salary goes into allowances, deductions, and net take-home pay.

- Tax Planning: The calculator helps employees understand how much tax they need to pay, facilitating better tax planning and management of investments.

- Customizable: Modern salary structure calculators allow users to input customized figures for allowances, deductions, and contributions, making them versatile for different salary structures and industries.

How Does the Salary Structure Calculator Work?

A Salary Structure Calculator is usually web-based, built using PHP, JavaScript, and HTML, to make it accessible and easy to use. Below is a step-by-step breakdown of how to use it:

- Input Basic Salary: Enter your basic salary, which forms the foundation for calculating other salary components like HRA, PF, and more.

- Add Allowances: Include House Rent Allowance (HRA), Conveyance Allowance, Medical Allowance, and other perks based on your salary structure.

- Enter Deductions: Input deductions like Provident Fund (PF) contributions, professional tax, and any income tax applicable under the new or old regime.

- Bonus and Incentives: If your salary package includes bonuses or performance incentives, add them to the calculator.

- View Results: The calculator instantly shows a detailed breakdown of your salary structure, including your net take-home salary after all deductions and allowances.

Benefits of Using a Salary Structure Calculator for Employers

For businesses, a salary structure calculator helps in creating a balanced and transparent salary package for employees. It ensures:

- Consistency: Ensures that salaries are computed uniformly across all employees.

- Compliance: Meets regulatory standards for taxes, Provident Fund, and other mandatory contributions.

- Budgeting: Helps employers estimate the total cost of employee compensation, aiding in better financial planning and resource allocation.

Benefits of Using a Salary Structure Calculator for Employees

Employees can benefit from using a salary structure calculator to:

- Understand Take-Home Pay: Know the exact amount you’ll receive after taxes and deductions.

- Tax Optimization: Plan your investments and tax-saving measures more effectively.

- Financial Planning: Helps you map out your finances, enabling better savings and investment decisions.

Conclusion

A Salary Structure Calculator is an indispensable tool for both employees and employers. It offers clarity, accuracy, and simplicity in understanding how salary components like basic pay, allowances, and deductions affect your take-home pay. Whether you’re negotiating a new salary or just trying to make sense of your current payslip, this tool can be a real game-changer.

For those looking for a user-friendly salary calculator, consider checking out customizable calculators on websites like CalculatorKart.com, which provide easy-to-use solutions for calculating your salary structure.

Understanding Salary: Key Components and Factors Influencing Compensation

In today’s professional landscape, salary plays a crucial role in our financial well-being and career growth. Whether you’re a job seeker, an employee, or an employer, understanding salary and its various components can help in making informed decisions. But what exactly does salary entail? Is it just the amount credited to your bank account each month? Not quite. In this blog, we’ll explore the basics of salary, its structure, the factors influencing it, and why understanding your salary is essential for financial planning.

What is Salary?

A salary is the fixed payment made by an employer to an employee in exchange for their work and services, typically disbursed on a monthly or annual basis. Salary serves as compensation for the employee’s time, skills, and effort, and it is often structured in a way that includes several components, not just the basic salary.

While salary is primarily a financial reward, it also reflects the value an organization places on an employee’s role, expertise, and contribution.

Components of Salary

Understanding your salary isn’t just about looking at the final figure on your payslip. Salaries are generally made up of several components, including both earnings and deductions. Here’s a breakdown of some common salary components:

- Basic Salary: The fixed portion of your salary, usually forming 40% to 50% of your total compensation. This amount is fully taxable and serves as the base for calculating other salary components.

- Allowances:

- House Rent Allowance (HRA): An allowance offered to cover rent expenses, with tax exemptions under certain conditions.

- Conveyance Allowance: Paid to cover commuting expenses. It is tax-exempt up to a certain limit.

- Medical Allowance: Provided to cover medical expenses, subject to tax exemptions.

- Special Allowance: A residual component that makes up the remaining part of your salary after other allowances.

- Bonus: This is typically offered as a reward for good performance or during festive seasons, either as a fixed amount or a percentage of your salary.

- Overtime Pay: Extra pay awarded for working beyond regular hours, which is generally calculated as a percentage of the basic salary.

- Deductions:

- Provident Fund (PF): A retirement savings scheme where both the employee and employer contribute, typically 12% of the employee’s basic salary.

- Professional Tax: A state-imposed tax, with rates varying from state to state in India.

- Income Tax: Deducted at source based on your taxable income, as per the applicable tax slabs.

- Health Insurance/Other Contributions: Some employers deduct amounts for health insurance or welfare schemes.

- Perquisites (Perks): These are non-cash benefits provided by the employer, such as company cars, subsidized meals, and accommodation. Some perks are taxable.

Types of Salary

There are different types of salary, depending on how the employee is paid:

- Gross Salary: The total amount of money an employee earns before deductions, which includes basic salary, allowances, bonuses, etc.

- Net Salary: Also known as take-home pay, this is the amount you receive after all deductions like taxes, PF, and other contributions.

- Cost to Company (CTC): This is the total amount that a company spends on an employee, including salary, benefits, bonuses, and any other perks.

Factors Influencing Salary

Several factors influence how much an individual earns, including:

- Experience and Qualifications: Generally, more experienced and highly qualified individuals command higher salaries due to their expertise.

- Industry: Certain industries, such as technology, healthcare, and finance, tend to offer higher salaries compared to others like education or hospitality.

- Location: Salaries vary based on geographic location. For instance, urban areas like Mumbai or Delhi tend to have higher salary ranges than smaller cities or rural areas.

- Role and Responsibilities: More specialized or managerial roles often come with higher pay, given the responsibilities involved.

- Company Size and Reputation: Larger, more established companies typically offer better compensation packages than smaller or startup businesses.

- Market Demand: If a specific skill set is in high demand but short supply, employers tend to offer higher salaries to attract talent.

- Negotiation Skills: How well you negotiate your salary during the hiring process can significantly affect your overall compensation.

Why Understanding Your Salary is Important

Understanding your salary is crucial for various reasons:

- Financial Planning: Knowing how much you earn and how it’s structured allows you to plan your finances better. You can budget for essential expenses, savings, and investments.

- Tax Management: Understanding your salary structure helps in effective tax planning. For instance, maximizing your HRA or claiming deductions under sections like 80C, 80D, etc., can reduce your taxable income.

- Career Decisions: Being aware of your salary’s breakdown gives you leverage in negotiations, be it for a new job or during a promotion discussion.

- Retirement Planning: Knowing how much is contributed to your Provident Fund and other savings schemes allows for better retirement planning, ensuring long-term financial stability.

- Salary Comparisons: By understanding salary structures, you can compare offers from different employers and choose the one that best aligns with your financial and career goals.

Conclusion

A salary is much more than just the money that lands in your bank account every month. It’s a well-structured compensation package that includes a variety of components—each serving a specific purpose. Whether you’re an employee trying to understand your pay or an employer structuring compensation packages, understanding the nuances of salary is key to financial well-being and career advancement.

By breaking down and analyzing each component, you can optimize your tax planning, negotiate better, and make informed career and financial decisions. So next time you receive your payslip, take a closer look—you’ll be surprised by how much you can learn!

Stay tuned for more insights on salary structures and financial planning. Visit CalculatorKart.com to use our Salary Structure Calculator and get an in-depth breakdown of your salary today!

Disclaimer

The information provided by the Salary Structure Calculator is for general informational purposes only. The calculations are based on standard assumptions and formulas, and while we strive to provide accurate results, the values displayed may not reflect the actual salary structure of your specific job or location. Factors such as company policies, local tax regulations, bonuses, and other components may affect your salary. Always consult with your employer or a financial expert for precise salary details and personalized advice.

We are not responsible for any discrepancies, errors, or losses resulting from the use of this calculator. Use this tool at your own discretion.