Simplify your loan planning with our EMI Calculator. Get accurate monthly payment estimates in seconds—try it now and make informed financial decisions!

User Guide: How to Use the EMI Calculator

Need to manage your loan payments? Use our EMI Calculator to find out your monthly dues. Start budgeting smarter and take control of your finances now!

Explanation

- HTML: Provides the structure of the form where users enter their loan details.

- CSS: Styles the page for a better user experience.

- JavaScript: Handles the form submission, performs EMI calculations, and updates the results on the page.

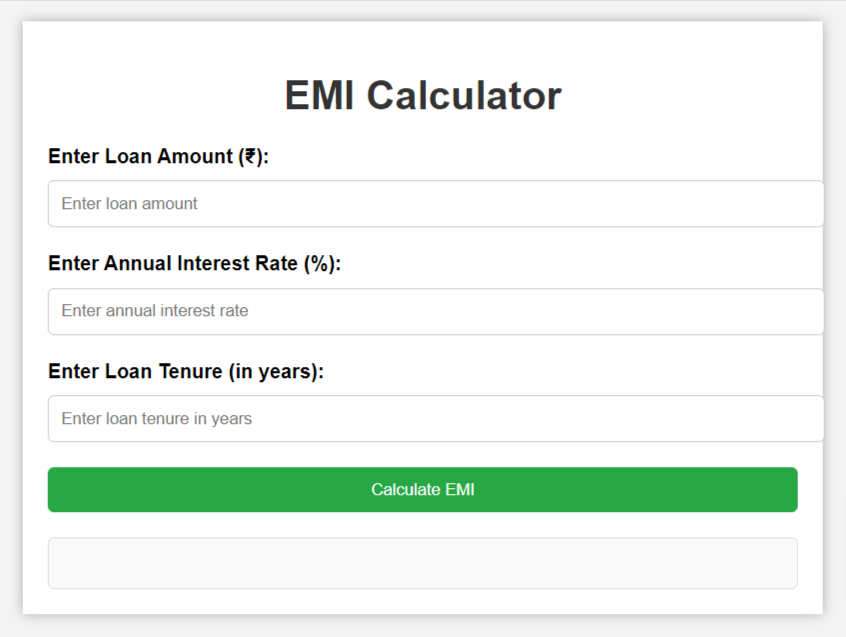

How to Use

- Enter Loan Amount: Input the total loan amount in Indian Rupees.

- Enter Annual Interest Rate: Provide the annual interest rate as a percentage.

- Enter Loan Tenure: Specify the loan tenure in years.

- Calculate EMI: Click the “Calculate EMI” button to see the results displayed below the form.

Worried about loan payments? Our EMI Calculator helps you find exact monthly amounts easily. Start using it today for better financial planning!

How to Use the EMI Calculator

The EMI (Equated Monthly Installment) Calculator helps you determine the monthly EMI amount you need to pay for a given loan amount, interest rate, and loan tenure. The tool also provides the total payment amount over the loan tenure and the total interest paid.

Take the guesswork out of loans! Use our EMI Calculator to calculate your monthly payments quickly and easily. Start planning for your future now!

Steps to Use the EMI Calculator

Step 1: Access the EMI Calculator

- Open the EMI Calculator page in your web browser.

Step 2: Enter the Loan Details

- Loan Amount: Input the total amount of the loan you wish to take. This should be the principal amount of the loan.

- Field: Enter Loan Amount (₹)

- Type: Number

- Annual Interest Rate: Enter the annual interest rate applicable to your loan. This rate is expressed as a percentage.

- Field: Enter Annual Interest Rate (%)

- Type: Number

- Loan Tenure: Provide the duration of the loan in years.

- Field: Enter Loan Tenure (in years)

- Type: Number

Step 3: Calculate EMI

- After entering the required details, click the “Calculate EMI” button.

Step 4: View Results

- The results will be displayed in the results section below the form. The results include:

- Monthly EMI: The amount you need to pay each month.

- Total Payment (Over Loan Tenure): The total amount paid over the entire duration of the loan.

- Total Interest: The total interest paid over the loan tenure.

Example

- Enter Loan Amount: ₹1,000,000

- Enter Annual Interest Rate: 7%

- Enter Loan Tenure: 15 years

- Click “Calculate EMI”

- Monthly EMI: ₹8,988.10

- Total Payment (Over Loan Tenure): ₹1,618,958.58

- Total Interest: ₹618,958.58

Tips

- Ensure that the values entered are accurate to get precise results.

- The interest rate should be entered as a percentage (e.g., 7 for 7%).

- The tenure should be entered in years (e.g., 15 for 15 years).

EMI Calculator: Simplifying Loan Repayments

In today’s fast-paced world, managing finances efficiently is crucial, especially when it comes to borrowing money for big-ticket items like homes, cars, or personal expenses. One of the most important tools that can help you plan your finances better when taking out a loan is an EMI Calculator. Whether you are taking out a home loan, personal loan, or car loan, understanding how EMIs (Equated Monthly Installments) work can help you make informed decisions about your financial commitments.

What is an EMI?

EMI stands for Equated Monthly Installment, a fixed payment amount made by a borrower to a lender at a specified date each calendar month. EMIs are used to pay off both the principal amount and the interest on the loan over a specific loan tenure. An EMI essentially breaks down your loan repayment into manageable monthly chunks.

Each EMI payment consists of two components:

- Principal Repayment: The portion of the EMI that goes towards repaying the original loan amount.

- Interest Payment: The portion of the EMI that covers the interest on the outstanding loan amount.

Over time, the interest component decreases, and the principal component increases. This is called the reducing balance method, which is commonly used by banks for loan repayments.

What is an EMI Calculator?

An EMI Calculator is an online financial tool that helps you calculate the EMI for any loan amount. It’s easy to use, quick, and allows you to experiment with different loan amounts, interest rates, and tenures to find the right loan for your budget. The calculator provides you with a clear picture of how much you will need to repay each month, helping you make informed decisions before committing to any loan.

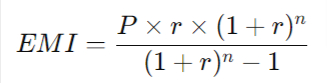

How Does an EMI Calculator Work?

An EMI Calculator uses a simple mathematical formula to compute your EMI. The formula is:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1+r)^n}{(1+r)^n – 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

- P is the principal loan amount

- r is the monthly interest rate (annual interest rate divided by 12)

- n is the loan tenure in months

For instance, if you borrow ₹10,00,000 at an annual interest rate of 10% for 10 years, your EMI would be calculated using this formula.

Benefits of Using an EMI Calculator

- Easy Loan Comparison: With an EMI calculator, you can compare different loan options by adjusting variables like loan amount, interest rate, and tenure.

- Better Financial Planning: Knowing your EMI in advance helps you plan your monthly budget, ensuring you can comfortably manage loan repayments alongside other expenses.

- Quick Calculations: Instead of manually calculating EMI using complex formulas, an EMI calculator provides results instantly.

- Visualizing Repayment Schedule: Some advanced EMI calculators also show amortization schedules, which break down each payment into principal and interest components, helping you understand the repayment process.

Types of EMI Calculators

There are different types of EMI calculators depending on the loan type:

- Home Loan EMI Calculator: Calculate EMIs for home loans, based on loan amount, interest rate, and tenure.

- Personal Loan EMI Calculator: For personal loans, where loan amounts are typically smaller and tenures shorter.

- Car Loan EMI Calculator: Focused on car loans, which usually come with different terms and interest rates compared to home or personal loans.

How to Use an EMI Calculator?

Using an EMI Calculator is simple. Follow these steps:

- Enter the Loan Amount: Specify how much you wish to borrow.

- Input the Interest Rate: Provide the annual interest rate for the loan.

- Select Loan Tenure: Choose the period over which you want to repay the loan, usually in months or years.

- View the EMI: The calculator will instantly display the EMI based on the entered values.

You can try different combinations of loan amounts, interest rates, and tenures to see how your EMI changes.

Why Use an EMI Calculator?

An EMI calculator is a handy tool for anyone looking to take out a loan. It helps in budgeting by giving you a clear idea of your monthly obligations. It also helps you avoid financial strain by allowing you to explore different loan options and choose the one that fits your financial profile. Additionally, it enables you to negotiate better loan terms with lenders, as you’ll know exactly what to expect in terms of monthly repayments.

Try More Calculators:

- Salary Structure Calculator

- TDS Calculator

- GST Calculator

- Inflation Calculator

- Future Value Inflation Calculator

Conclusion

In a world where loans play a crucial role in helping people achieve their dreams, an EMI Calculator becomes an essential tool. It simplifies loan planning and gives borrowers a clear sense of their financial commitments, making the loan process more transparent and manageable.

Before you take out a loan, always use an EMI calculator to get a precise idea of how much you’ll need to pay each month. This not only helps in managing your finances but also ensures you’re making an informed decision.

Ready to calculate your EMI? Try our EMI Calculator today and take control of your financial future!