User Guide: How to Use the Atal Pension Yojana (APY) Calculator

Code Explanation

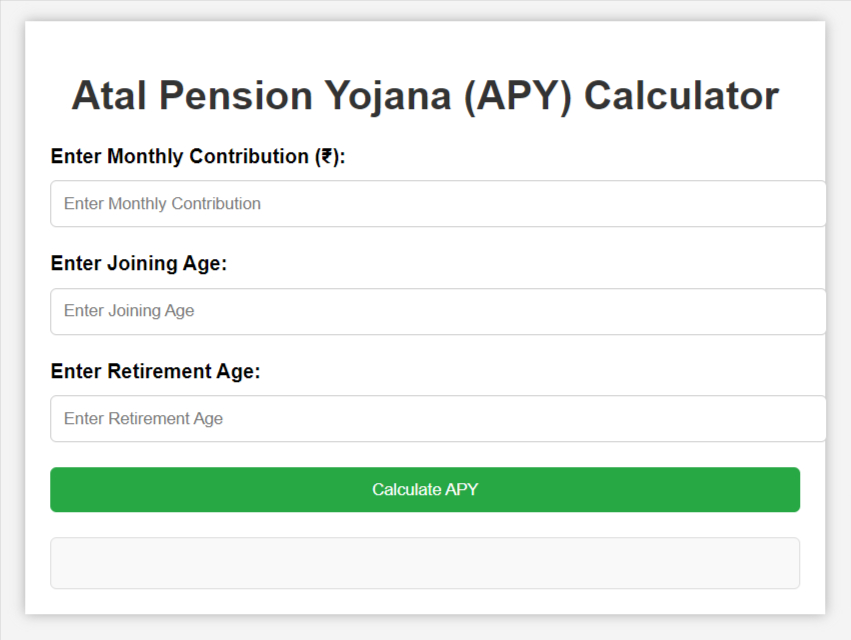

- Form Fields

- Monthly Contribution: User inputs their monthly contribution to the APY.

- Joining Age: User inputs their age when they start the APY.

- Retirement Age: User inputs their age when they plan to retire.

- PHP Code

- Retrieves and validates input values.

- Uses a fixed interest rate (e.g., 7.5%) as per APY guidelines.

- Calculates the total amount accumulated at retirement using the compound interest formula.

- Displays the total contributions, final amount at retirement, and APY percentage.

- Form Submission

- The form uses POST method to send data to the PHP script, which processes the input and calculates the APY based on the provided values.

This code provides an accurate calculation for the Atal Pension Yojana based on the most common parameters used in the scheme.

How to Use the Atal Pension Yojana (APY) Calculator

Welcome to the Atal Pension Yojana (APY) Calculator! This guide will walk you through how to use the calculator to determine your potential returns from the APY scheme.

Steps to Use the APY Calculator

Step 1. Open the Calculator

- Open the HTML file in your web browser where the calculator is hosted.

Step 2. Enter Monthly Contribution

- In the field labeled “Enter Monthly Contribution (₹)”, input the amount you plan to contribute each month to your APY account. This value should be in Indian Rupees (₹) and can be a decimal value (e.g., 500.50).

Step 3. Enter Joining Age

- In the “Enter Joining Age” field, input your age when you start investing in the APY scheme. The age must be between 18 and 39 years.

Step 4. Enter Retirement Age

- In the “Enter Retirement Age” field, specify the age at which you plan to retire. This must be a value between 19 and 65 years, and it should be greater than your joining age.

Step 5. Submit the Form

- Click the “Calculate APY” button to submit your inputs. The calculator will process the information and display the results.

Understanding the Results

Once you submit the form, the calculator will display the following information:

- Monthly Contribution: Shows the amount you are contributing monthly.

- Joining Age: The age at which you start your investment.

- Retirement Age: The age at which you plan to retire.

- Investment Duration: The number of years your investment will be held (Retirement Age – Joining Age).

- Total Contributions: The total amount you have contributed over the entire investment period.

- Final Amount at Retirement: The estimated amount you will have at the time of retirement, considering the fixed interest rate and compounding.

- APY (Annual Percentage Yield): The effective annual rate of return on your investment.

Additional Notes

- Interest Rate: The calculator uses a fixed interest rate of 7.5% per annum for the APY scheme as per the latest government guidelines. This rate is used to calculate the compounded returns on your contributions.

- Compounding Frequency: The calculator assumes monthly compounding for the interest calculation.

Make sure to input valid numeric values within the allowed ranges for accurate results. If you encounter any issues or need further assistance, please consult the APY scheme guidelines or reach out to a financial advisor.

Enjoy using your APY Calculator to plan for a secure and comfortable retirement!

Try More Calculators:

Atal Pension Yojana (APY) Calculator: A Smart Tool to Plan Your Retirement

Planning for a financially secure retirement is crucial, and the Atal Pension Yojana (APY) offers a structured way to ensure monthly pension benefits. But how do you know how much to contribute to receive your desired pension?

The Atal Pension Yojana (APY) Calculator is here to help! This user-friendly tool assists you in determining the exact monthly contribution you need to make today for a guaranteed pension when you retire. In this blog post, we’ll explore how the APY Calculator works, its benefits, and why you should use it for better financial planning.

What is the Atal Pension Yojana (APY)?

Before diving into the APY Calculator, let’s quickly recap the scheme. The Atal Pension Yojana is a government-backed pension program aimed at individuals in the unorganized sector, but open to all Indian citizens aged between 18 and 40.

The scheme guarantees a fixed monthly pension ranging from ₹1,000 to ₹5,000, based on the amount contributed and the age at which you start.

What is the Atal Pension Yojana (APY) Calculator?

The APY Calculator is an online tool that helps you estimate how much you need to contribute monthly to receive a guaranteed pension after the age of 60. By inputting a few details, such as your age and desired pension amount, the calculator will instantly provide the required monthly contribution.

This tool is especially useful if you are unsure about how much you need to save each month for a comfortable retirement. Instead of guessing, you can plan your contributions more effectively with the APY Calculator.

How to Use the APY Calculator?

The APY Calculator is designed to be easy to use and can be accessed online via various banking websites or pension portals. Here’s how you can use it:

Step 1. Enter Your Age

- The first step is to input your current age (must be between 18 and 40).

Step 2. Select the Desired Pension Amount

- The next step is to choose the amount of pension you would like to receive after retirement. Options are ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 per month.

Step 3. Calculate Monthly Contribution

- Once you input your age and desired pension, the calculator will instantly display the amount you need to contribute each month to meet your retirement goals.

Step 4. View Contribution Schedule

- Many calculators also provide a detailed schedule showing the total amount you will contribute over time, helping you get a clearer picture of your long-term savings.

Example Calculation

To give you an idea of how the APY Calculator works, here’s an example:

- Age: 30 years

- Desired Pension: ₹5,000 per month

After entering these details, the calculator might show that you need to contribute approximately ₹577 per month to receive a guaranteed monthly pension of ₹5,000 at age 60. If you were younger (e.g., 20 years), the monthly contribution would be lower.

Benefits of Using the APY Calculator

- Accurate Financial Planning

- The APY Calculator allows you to determine exactly how much you need to contribute, making it easier to plan your retirement savings without guesswork.

- Easy to Use

- With just a few inputs (age and desired pension), you can quickly determine the monthly contribution, saving you time and effort in manual calculations.

- Customizable for Individual Goals

- Whether you want a smaller pension of ₹1,000 or a higher one of ₹5,000, the calculator adjusts your contributions accordingly, helping you tailor your plan to your financial goals.

- Avoid Over- or Under-Contributing

- By using the calculator, you can avoid over-contributing, which could tie up funds unnecessarily, or under-contributing, which could result in not meeting your retirement goals.

- Visualize Long-Term Savings

- The calculator provides a clear overview of your long-term savings. You can see the total contributions you’ll make over the years, giving you a sense of how much you’re saving for retirement.

Why Should You Use an APY Calculator?

The APY Calculator takes the guesswork out of retirement planning. It simplifies the process of determining your monthly contributions based on your specific goals. Without a proper plan, you may not contribute enough, resulting in a lower pension. On the other hand, contributing too much may strain your current finances unnecessarily.

By using this calculator, you can strike the right balance between saving for the future and managing your present financial needs.

Where to Access the Atal Pension Yojana (APY) Calculator?

The APY Calculator is available on several government portals, bank websites, and financial planning tools. You can visit any of these sites to use the calculator for free:

- UnifiedPensionScheme.ind.in

- CalculatorKart.com

- National Pension System (NPS) Portal

- Bank websites such as SBI, PNB, or ICICI

The Atal Pension Yojana (APY) is an excellent pension scheme for securing your retirement, and using the Atal Pension Yojana Calculator makes it even easier to plan your contributions. Whether you are just starting your career or already in your 30s, the APY Calculator helps you make informed decisions about how much you need to save each month for a worry-free retirement.

Take advantage of this tool today and ensure you’re on the right path to financial independence in your golden years. For more information on the Atal Pension Yojana and other pension-related schemes, visit UnifiedPensionScheme.ind.in or consult your bank.

Atal Pension Yojana (APY): A Guide to Securing Your Retirement

The Atal Pension Yojana (APY) is a government-backed pension scheme aimed at providing financial security during retirement, particularly for individuals in the unorganized sector. Launched in 2015 by the Government of India, the scheme helps ensure a steady source of income post-retirement through small monthly contributions during the working years.

If you’re looking for a reliable pension plan, the APY could be an ideal choice. Here’s everything you need to know about this scheme.

What is Atal Pension Yojana (APY)?

The Atal Pension Yojana is designed to provide a guaranteed monthly pension ranging from ₹1,000 to ₹5,000 to subscribers, depending on their contributions and the age at which they start investing. The scheme mainly targets workers in the unorganized sector but is open to all citizens of India within the specified age bracket.

Key Features of Atal Pension Yojana

Eligibility

- The APY is available to all Indian citizens between the ages of 18 and 40 years.

- The individual must have a savings bank account or post office savings account to enroll in the scheme.

- It is mandatory for subscribers to provide Aadhaar as an identification proof.

Monthly Pension Benefits

- Subscribers can opt for a pension amount of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000, which will be provided upon reaching the age of 60.

- The amount of contribution varies based on the age of entry and the pension amount chosen.

Government Co-Contribution

The government provides co-contribution to eligible subscribers who are not covered by any statutory social security scheme or are not income taxpayers. This contribution was valid for those who joined between June 2015 and December 2015.

Guaranteed Pension

APY guarantees a fixed pension to the subscriber after they turn 60, making it a reliable choice for individuals seeking a secure retirement plan.

Nomination Facility

The APY allows subscribers to nominate their spouse or family members, ensuring that the pension is passed on to their family in case of death.

Contribution Details

The contribution amount depends on the age at which you join the scheme and the pension amount you wish to receive. Here’s a brief breakdown of how contributions work:

- If you join at 18, you can contribute as little as ₹42 per month for a pension of ₹1,000.

- If you join at 40, the contribution amount will be higher — approximately ₹291 per month for the same pension.

- The contributions are auto-debited from the subscriber’s savings account every month, ensuring a hassle-free payment process.

Benefits of Atal Pension Yojana

Financial Security in Retirement

- The APY offers a stable monthly income post-retirement, making it easier to cover basic living expenses during your senior years.

Affordable Contributions

- The APY is designed to be accessible for low-income individuals, with minimal monthly contributions starting as low as ₹42.

Tax Benefits

- Contributions made towards the APY are eligible for tax deductions under Section 80CCD of the Income Tax Act, offering added financial benefits to subscribers.

Long-Term Savings

- The scheme encourages long-term savings, helping individuals build a retirement corpus steadily over the years.

How to Enroll in Atal Pension Yojana?

Enrolling in the APY is simple and can be done through any nationalized bank or post office. Here are the steps to follow:

Step 1. Visit Your Bank or Post Office

- You can apply for the APY through the branch of your bank or post office where you hold an account.

Step 2. Submit APY Application Form

- Fill out the APY registration form, which can be downloaded from your bank’s website or obtained from the branch.

Step 3. Provide Aadhaar and Contact Details

- You will need to submit your Aadhaar card and other details, such as your mobile number, to complete the registration process.

Step 4. Specify Contribution Amount

- Choose the desired pension amount (₹1,000 to ₹5,000) and allow for auto-debit from your savings account for monthly contributions.

Step 5. Receive Confirmation

- Once registered, you will receive a confirmation message about your APY account and details of the contributions.

Conclusion

The Atal Pension Yojana is an excellent pension scheme for those looking to secure their financial future during retirement, especially for individuals working in the unorganized sector. With guaranteed pension benefits, affordable contributions, and the backing of the Government of India, the APY offers peace of mind and financial stability in your golden years.

By starting early and contributing regularly, you can ensure a comfortable and financially independent life post-retirement. So, if you haven’t already, consider enrolling in the Atal Pension Yojana today and take a step toward a secure and stress-free future.

For more detailed information and updates on pension schemes, visit sarkariyojana247.com or consult your local bank or post office for guidance.