User Guide: How to Use Net Salary Calculator

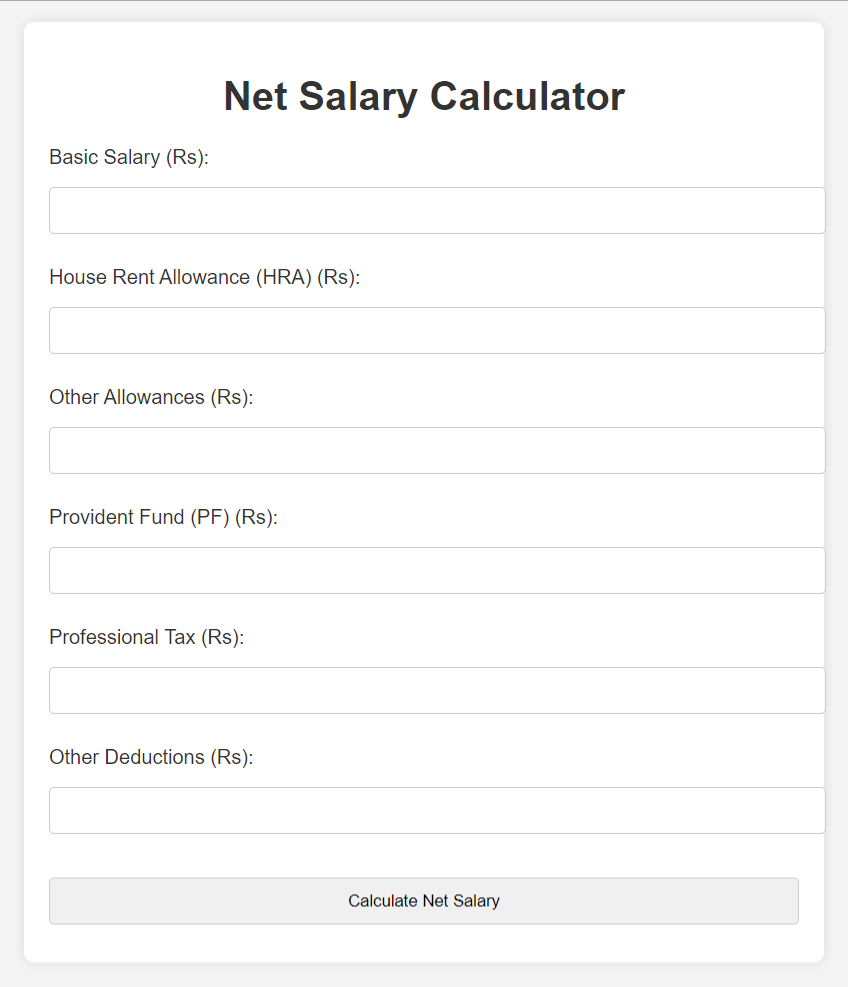

The Net Salary Calculator is a web-based tool designed to help you calculate your detailed salary structure based on your input. This calculator allows users to input their basic salary, allowances, deductions, and other parameters to calculate the net salary.

This setup provides a user-friendly salary calculator that ensures accurate net salary calculations with real-time input validation. This guide will help you understand how to use the Advanced Salary Calculator to compute your net salary based on your earnings and deductions.

Code Explanation

HTML Structure

- The form includes fields to input the basic salary, HRA, other allowances, PF, professional tax, and other deductions.

- All fields are required and use type=”number” to ensure numeric input.

PHP Processing

- Upon form submission, PHP processes the inputs.

- Total earnings are calculated by summing the basic salary, HRA, and other allowances.

- Total deductions are calculated by summing PF, professional tax, and other deductions.

- The net salary is calculated by subtracting the total deductions from the total earnings.

- The results are displayed, including a breakdown of earnings, deductions, and the net salary.

JavaScript

- A small script prevents negative values in the input fields by setting them to zero if a negative value is entered.

How to Use the Net Salary Calculator

Steps to use the Net Salary Calculator

Step 1. Basic Salary (Rs)

- Enter your monthly Basic Salary amount in Indian Rupees (Rs).

- This is a mandatory field and must be filled with a positive number.

Step 2. House Rent Allowance (HRA) (Rs)

- Enter the amount you receive as House Rent Allowance (HRA).

- This is also mandatory, and the value should be positive.

Step 3. Other Allowances (Rs)

- Input any other additional allowances, such as travel, medical, or special allowances.

- This field is required for accurate calculations.

Step 4. Provident Fund (PF) (Rs)

- Enter the amount deducted for Provident Fund (PF) contributions.

- This amount will be subtracted from your total earnings to calculate net salary.

Step 5. Professional Tax (Rs)

- Provide the amount deducted for Professional Tax as per your state’s regulations.

- This is a mandatory deduction field.

Step 6. Other Deductions (Rs)

- If you have any additional deductions such as loans or other salary-based deductions, enter the amount here.

Step 7. Calculate Net Salary

- Once all fields are filled, click the “Calculate Net Salary” button.

- The calculator will process the inputs and display the results.

Calculation Breakdown

- Total Earnings: The sum of your Basic Salary, HRA, and Other Allowances.

- Total Deductions: The sum of PF, Professional Tax, and Other Deductions.

- Net Salary: The amount remaining after subtracting the Total Deductions from the Total Earnings.

Example Calculation

If you entered:

- Basic Salary: Rs 30,000

- HRA: Rs 10,000

- Other Allowances: Rs 5,000

- PF: Rs 2,000

- Professional Tax: Rs 200

- Other Deductions: Rs 500

The calculator would show:

- Total Earnings: Rs 45,000

- Total Deductions: Rs 2,700

- Net Salary: Rs 42,300

Additional Information

- All input values must be positive numbers. Negative values will automatically be set to zero.

- Ensure all fields are filled before clicking the Calculate Net Salary button to avoid errors.

This calculator provides an easy and effective way to calculate your net salary after considering your earnings and deductions.

Key Features of the Calculator

Real-Time Validation

The calculator ensures that you cannot enter negative values in any of the fields. If you attempt to input a negative number, it will automatically reset to zero, ensuring accuracy and avoiding calculation errors.

User-Friendly Interface

The simple and clean design makes it easy for users to navigate. Each input field is clearly labeled, and the Calculate Net Salary button is prominent and easily accessible.

The results section appears below the form after submitting the values, providing a breakdown of the total earnings, total deductions, and net salary.

Troubleshooting and Tips

Fields are Blank or Incorrect

- Ensure all fields are filled with positive numeric values. The form will not work correctly if any fields are left empty or contain incorrect inputs.

- If a mistake is made in an input, you can easily correct it by changing the value and clicking the Calculate Net Salary button again.

How to Refresh/Reset

To start over with new values, simply refresh the page or modify any input fields. The calculator will automatically update with the new values after you submit the form again.

Performance Considerations

The calculator is lightweight and will run efficiently on any modern browser. For the best experience, ensure your browser is up to date. If any issues arise, try refreshing the page or clearing your browser cache.

By following these instructions and tips, you can effectively use the Advanced Salary Calculator to gain an accurate understanding of your monthly net salary.

Benefits of Using the Advanced Salary Calculator

Accurate Salary Calculation

The calculator eliminates the need for manual calculations, which can be prone to errors. By inputting your salary components and deductions, you get an accurate calculation of your net salary, helping you plan your finances better.

Comprehensive Breakdown

This calculator not only gives you the final net salary but also provides a detailed breakdown of your total earnings and total deductions, giving you a clear view of how your salary is structured.

Practical Use Cases

Budget Planning

By calculating your net salary after deductions, you can better plan your monthly budget. Knowing exactly how much take-home pay you will receive helps in managing your expenses, savings, and investments more effectively.

Salary Negotiations

If you’re considering a job offer or negotiating your current salary, this calculator helps you understand how various allowances and deductions affect your net income. It can assist in making informed decisions during negotiations with your employer.

Tax Planning

Understanding your salary structure and deductions like Provident Fund and Professional Tax enables you to make better tax planning decisions. This calculator can help you identify areas where you might want to adjust contributions or allowances to optimize your taxable income.

Frequently Asked Questions (FAQs)

What is the Net Salary?

Net salary is the amount you take home after all deductions (such as PF, Professional Tax, and other deductions) are subtracted from your total earnings (Basic Salary, HRA, and other allowances).

Why are negative values not allowed in the input fields?

Negative values are disallowed because they would result in incorrect salary calculations. The calculator is designed to ensure all values are positive to maintain accuracy and reliability.

Can I use this calculator for annual salary calculations?

This calculator is designed for monthly salary calculations. To use it for annual salary, you can input your yearly salary components, but keep in mind the results will reflect monthly amounts unless you adjust for the entire year manually.

Try More Calculators:

Enhancing Financial Literacy

This salary calculator not only provides you with your net salary but also enhances your financial awareness. Understanding the key components of your salary—earnings and deductions—empowers you to make more informed decisions regarding savings, investments, and lifestyle choices.

Regular use of this tool can improve your overall financial literacy and help you stay on top of your finances throughout your career.