User Guide: How to Use Home Loan EMI Calculator

The Home Loan EMI Calculator helps you determine the Equated Monthly Installment (EMI) for a home loan based on your loan amount, interest rate, and loan tenure. This tool calculates the monthly payment amount, total payment over the tenure, and total interest payable.

How to Use the Home Loan EMI Calculator

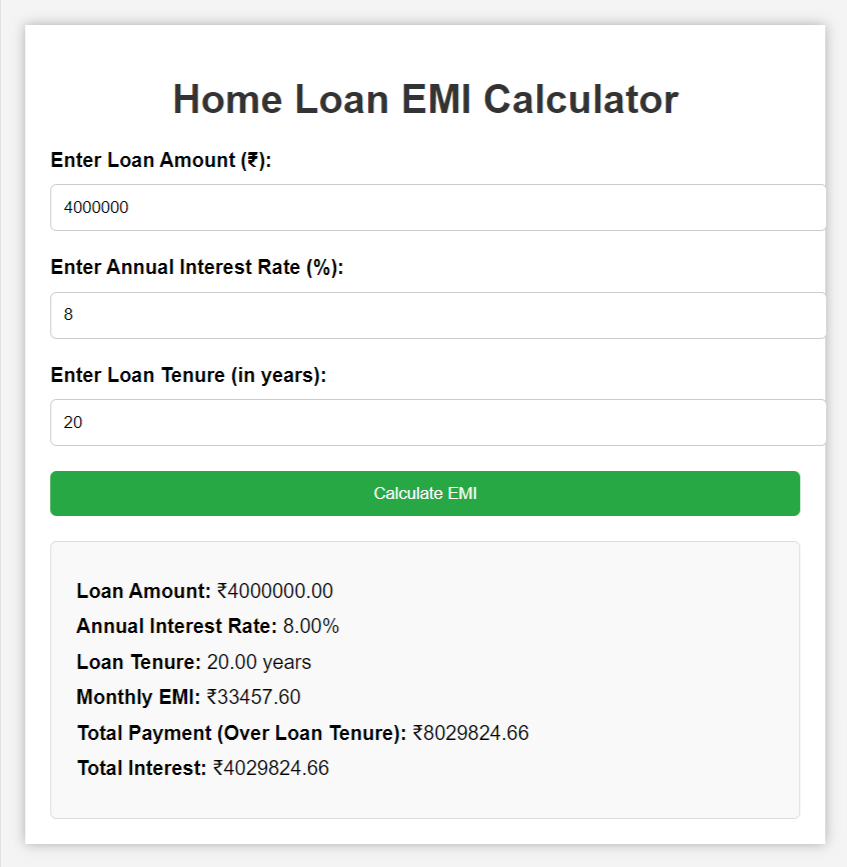

Step 1: Access the Calculator

Open the Home Loan EMI Calculator in your web browser. The calculator will be displayed with input fields for loan details and a submit button.

Step 2: Enter Loan Details

You need to provide the following information:

- Loan Amount (₹):

- Enter the total amount of the loan you wish to take.

- Example: 5000000 for ₹5,00,000.

- Annual Interest Rate (%):

- Enter the annual interest rate applicable to your loan.

- Example: 7.5 for a 7.5% annual interest rate.

- Loan Tenure (in years):

- Specify the duration of the loan in years.

- Example: 20 for a 20-year loan tenure.

Step 3: Calculate EMI

- Click the “Calculate EMI” button.

Step 4: View Results

After clicking the button, the calculator will display the following results:

- Loan Amount:

- The amount of loan you entered.

- Annual Interest Rate:

- The annual interest rate you entered.

- Loan Tenure:

- The duration of the loan in years.

- Monthly EMI:

- The amount you need to pay each month as EMI.

- Total Payment (Over Loan Tenure):

- The total amount paid over the entire loan period, including both principal and interest.

- Total Interest:

- The total interest amount paid over the loan tenure.

Example

If you enter the following details:

- Loan Amount: ₹5,00,000

- Annual Interest Rate: 7.5%

- Loan Tenure: 20 years

The calculator might show:

- Monthly EMI: ₹4,037.88

- Total Payment (Over Loan Tenure): ₹9,68,968.99

- Total Interest: ₹4,68,968.99

Notes

- Ensure that you enter numerical values only. Avoid using commas or other non-numeric characters.

- The calculator uses standard formulas to compute the EMI based on the compound interest principle.

If you have any questions or need further assistance, feel free to reach out for support.

Home Loan EMI Calculator: Calculate Your Monthly EMI Easily

When you’re planning to buy a home, one of the most crucial steps is figuring out your finances. Understanding your monthly installments, or EMIs, is a key part of determining how affordable a home loan will be for you. This is where a Home Loan EMI Calculator comes in handy. It allows you to calculate your EMIs quickly and accurately, helping you plan your finances better.

In this blog post, we’ll cover everything you need to know about a Home Loan EMI Calculator, how it works, its benefits, and how you can use it to make informed financial decisions.

What is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is an online tool that helps you calculate the Equated Monthly Installment (EMI) for a home loan. An EMI is the fixed amount you pay every month to repay your home loan, consisting of both principal and interest. By using a home loan EMI calculator, you can easily determine the amount you will need to pay each month, based on the loan amount, interest rate, and loan tenure.

How Does the Home Loan EMI Calculator Work?

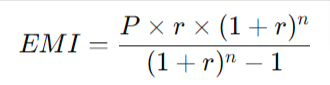

The EMI for a home loan is calculated using the following formula:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

- P = Loan Amount (Principal)

- r = Monthly Interest Rate (Annual Interest Rate ÷ 12 ÷ 100)

- n = Loan Tenure (in months)

The EMI calculator uses this formula to instantly calculate your EMI when you input the required values.

Key Inputs of a Home Loan EMI Calculator

To use a Home Loan EMI Calculator, you will need to provide the following inputs:

- Loan Amount (Principal): The amount of money you plan to borrow from the lender.

- Interest Rate: The annual interest rate charged by the lender.

- Loan Tenure: The period over which you plan to repay the loan, usually in years.

Based on these inputs, the calculator provides you with the monthly EMI, which includes both principal and interest components.

Benefits of Using a Home Loan EMI Calculator

- Instant Calculation: You get accurate EMI amounts instantly without having to manually calculate complex formulas.

- Better Financial Planning: By knowing your monthly EMI, you can plan your finances effectively and ensure that the EMI fits within your monthly budget.

- Compare Different Loan Scenarios: You can try different combinations of loan amounts, interest rates, and tenures to find the most suitable loan option for your financial situation.

- Transparency: A home loan EMI calculator provides a clear understanding of how much you’ll repay each month and over the entire tenure, making the loan process more transparent.

- Saves Time: With instant results, the EMI calculator saves time and effort, allowing you to make quick decisions.

How to Use a Home Loan EMI Calculator?

Using a Home Loan EMI Calculator is simple and straightforward. Here are the steps:

- Enter the Loan Amount: Input the amount of money you plan to borrow.

- Provide the Interest Rate: Enter the interest rate offered by the lender.

- Choose the Loan Tenure: Select the duration over which you plan to repay the loan.

Once you’ve entered these details, the calculator will instantly display your monthly EMI. Some advanced calculators also provide an amortization schedule, showing the breakup of principal and interest for each EMI.

Factors That Affect Your Home Loan EMI

- Loan Amount: A higher loan amount results in a higher EMI.

- Interest Rate: The interest rate significantly affects your EMI. Lower interest rates lead to lower EMIs.

- Loan Tenure: A longer loan tenure reduces your monthly EMI but increases the overall interest paid over the tenure.

- Prepayments: If you make prepayments towards your loan, it can reduce your outstanding principal, lowering your EMI or shortening your loan tenure.

Conclusion

A Home Loan EMI Calculator is a powerful tool that helps you plan your home loan repayment effectively. It allows you to estimate your monthly outflow and compare different loan scenarios, helping you choose the best option for your financial situation. Whether you’re a first-time homebuyer or looking to refinance, using this calculator can make the loan process much smoother and more transparent.

So, before you take the plunge into homeownership, use a Home Loan EMI Calculator to ensure you’re financially prepared for the journey ahead!

Would you like to explore a reliable Home Loan EMI Calculator? Try ours today to calculate your EMIs and plan your dream home purchase with confidence!

Home Loan EMI: Everything You Need to Know

Buying a home is a major financial decision that often involves taking out a home loan. For most homebuyers, repaying this loan in monthly installments, or EMIs (Equated Monthly Installments), is a crucial aspect of the process. Understanding how Home Loan EMIs work can help you manage your finances effectively and make informed decisions about your loan.

In this blog post, we will break down everything you need to know about Home Loan EMIs, including how they are calculated, factors affecting them, and tips to manage them efficiently.

What is Home Loan EMI?

A Home Loan EMI is the fixed monthly payment you make to your lender to repay your home loan. Each EMI includes two components:

- Principal: The amount of the loan you’ve borrowed.

- Interest: The charge you pay to the lender for borrowing the money.

The EMI amount is fixed throughout the loan tenure, making it easier for you to plan your monthly budget. Over the tenure of the loan, the proportion of the interest and principal components in the EMI changes. Initially, the EMI consists mostly of interest, but as the loan progresses, the principal component increases.

How is Home Loan EMI Calculated?

The EMI for a home loan is calculated using the following formula:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

- P = Loan Amount (Principal)

- r = Monthly Interest Rate (Annual Interest Rate ÷ 12 ÷ 100)

- n = Loan Tenure (in months)

Although the formula looks complex, online Home Loan EMI Calculators make it easy for you to calculate the EMI by entering the loan amount, interest rate, and tenure.

Factors That Affect Home Loan EMI

Several factors influence the EMI amount, including:

- Loan Amount (Principal): The larger the loan amount, the higher the EMI will be.

- Interest Rate: A lower interest rate reduces the EMI, while a higher interest rate increases it. Interest rates vary between lenders and are influenced by market conditions, your credit score, and the type of interest rate (fixed or floating).

- Loan Tenure: The longer the tenure, the lower the EMI, as the repayment is spread over a longer period. However, this also means paying more interest over time. Conversely, a shorter tenure results in a higher EMI but reduces the overall interest paid.

- Prepayments: If you make prepayments during the loan tenure, it reduces the outstanding principal, which in turn reduces your EMI or shortens your loan tenure.

- Type of Interest Rate:

- Fixed Interest Rate: The EMI remains constant throughout the loan tenure.

- Floating Interest Rate: The EMI may change depending on market fluctuations and changes in the lender’s base rate.

Types of EMI Structures

There are different types of EMI structures based on how the interest is calculated:

- Fixed Rate EMI: The interest rate remains constant throughout the loan tenure, so the EMI amount remains unchanged. This is beneficial if you prefer predictability in your monthly payments.

- Floating Rate EMI: The interest rate fluctuates with the market conditions. If the interest rate goes down, your EMI will decrease, and vice versa. This option is riskier but can save you money if interest rates fall during the loan tenure.

- Pre-EMI: In some cases, particularly for under-construction properties, you may only be required to pay the interest component of the loan (Pre-EMI) until the property is completed. Once possession is taken, the full EMI starts, which includes both principal and interest.

Tips for Managing Home Loan EMI

- Choose the Right Loan Tenure: Opting for a longer tenure reduces your monthly EMI, but it increases the overall interest paid. Shorter tenures have higher EMIs but save on interest costs. Choose a tenure that balances affordability with long-term savings.

- Prepay When Possible: If you receive a bonus or windfall, consider prepaying a portion of your loan. This reduces your outstanding principal, lowering your EMI or shortening your loan tenure.

- Negotiate for a Lower Interest Rate: A lower interest rate can significantly reduce your EMI. If your credit score has improved or if market rates have dropped, consider negotiating with your lender or switching to a different lender offering better rates.

- Budget Carefully: Ensure your home loan EMI fits comfortably within your monthly budget. Experts suggest that your EMI should not exceed 40% of your monthly income to maintain financial stability.

- Opt for a Floating Rate During Low-Interest Periods: If interest rates are expected to drop, a floating rate loan could save you money on EMIs. However, be prepared for potential rate increases.

Advantages of Knowing Your Home Loan EMI

- Financial Planning: Knowing your EMI helps you plan your monthly finances and avoid surprises. You can prepare for monthly outflows and ensure you can meet other financial obligations.

- Loan Comparison: By calculating the EMI for different loan amounts, interest rates, and tenures, you can compare various loan options from different lenders. This helps you choose the most affordable option for your financial situation.

- Amortization Schedule: Lenders often provide an amortization schedule, which shows the breakdown of your EMI into principal and interest components for each month. This transparency allows you to track your repayment progress over time.

Try More Calculators:

Conclusion

A Home Loan EMI is a critical aspect of buying a home through a loan. By understanding how it works, what factors affect it, and how you can manage it efficiently, you’ll be better prepared to handle your loan repayment. Always use a Home Loan EMI Calculator to ensure you choose a loan that aligns with your financial capacity and long-term goals.

Whether you’re a first-time homebuyer or looking to refinance an existing loan, taking the time to understand your EMI will make the journey smoother and more financially sound. Happy home buying!