Use our Loan Calculator to easily estimate your monthly payments. Get accurate results and plan your finances today. Try it now!

User Guide: How to Use the Loan Calculator

Need help with loans? Our Loan Calculator provides quick estimates on payments. Take control of your finances with just a few clicks!

Explanation of the Code

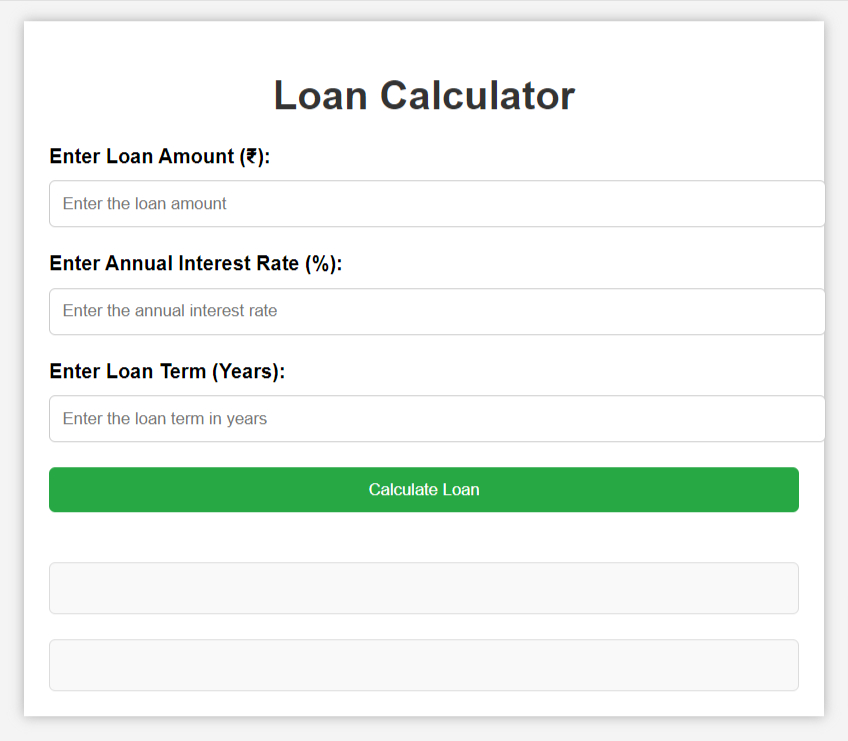

HTML Structure:

- A form (loanForm) is provided for user inputs.

- Three fields to input loan amount, annual interest rate, and loan term.

- A button to trigger the calculation.

CSS Styling:

- Basic styling to improve the appearance of the calculator and results.

JavaScript Functionality:

- Listens to the form submission event.

- Reads input values, calculates the monthly payment using the formula for an amortizing loan.

- Generates an amortization schedule and displays it in a table format.

Results and Amortization Schedule:

- Displays the calculated monthly payment.

- Shows a detailed amortization schedule, including payment number, payment amount, principal, interest, and balance for each payment.

How to Use the Loan Calculator

The Loan Calculator helps you compute the monthly EMI (Equated Monthly Installment) for a loan and provides a detailed amortization schedule. The calculator takes the loan amount, annual interest rate, and loan term as inputs and displays the monthly payment and a breakdown of each payment throughout the loan term.

Step 1. Open the Calculator:

- Navigate to the Loan Calculator page where the combined PHP, JavaScript, and HTML code is deployed.

Step 2. Enter Loan Details:

- Loan Amount (₹): Input the total amount of the loan you are borrowing. This should be the principal amount without interest.

- Annual Interest Rate (%): Enter the annual interest rate applicable to your loan. This rate should be expressed as a percentage (e.g., 7.5 for 7.5%).

- Loan Term (Years): Specify the total duration of the loan in years. For example, input “5” for a 5-year loan term.

Step 3. Calculate:

- Click the “Calculate Loan” button to initiate the calculation.

Step 4. View Results:

- Monthly Payment: After clicking the button, the monthly EMI will be displayed. This is the amount you need to pay every month for the entire term of the loan.

- Amortization Schedule: Below the monthly payment, you will see a detailed amortization schedule presented in a table. This schedule includes:

- Payment #: The sequential number of each payment.

- Payment (₹): The total amount paid each month.

- Principal (₹): The portion of the monthly payment that goes toward repaying the principal amount of the loan.

- Interest (₹): The portion of the monthly payment that goes toward paying the interest on the loan.

- Balance (₹): The remaining balance of the loan after each payment.

Step 5. Analyze the Results:

- Review the amortization schedule to understand how each payment contributes to reducing the principal and how much interest you will pay over the life of the loan.

Step 6. Additional Information:

- If you need to calculate a different loan, simply enter new values and click “Calculate Loan” again.

Tips:

- Make sure to enter accurate values for loan amount, interest rate, and loan term to get correct results.

- The amortization schedule can help you see how your payments are structured and how quickly the loan balance decreases over time.

Troubleshooting:

- If you encounter any issues or discrepancies with the results, ensure that all input fields are filled correctly and that the values are within the valid range (e.g., annual interest rate should be greater than 0).

Feel free to adjust the calculator as needed to fit specific requirements or preferences.

Understanding the Power of a Loan Calculator: Simplifying Your Loan Decisions

In today’s fast-paced world, loans play a crucial role in helping us fulfill our financial goals, be it buying a home, purchasing a car, or financing a business. However, the process of managing loan repayments can be daunting. This is where a loan calculator steps in to simplify your financial planning and ensure you stay on track with your repayments.

In this blog, we’ll explore what a loan calculator is, how it works, and why it’s an essential tool for anyone considering a loan.

What is a Loan Calculator?

A loan calculator is an online tool that helps you determine your monthly installment (EMI), total interest payable, and overall loan repayment schedule based on inputs such as the loan amount, interest rate, and loan tenure. Whether you’re applying for a personal loan, home loan, or car loan, the calculator gives you a clear picture of your repayment commitments.

How Does a Loan Calculator Work?

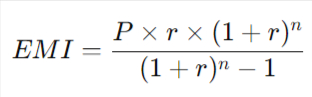

The loan calculator uses a basic formula to calculate your EMI:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual interest rate divided by 12)

- n = Loan tenure in months

By using this formula, the calculator helps you break down the repayment process into easy-to-understand monthly installments.

Key Inputs for a Loan Calculator

- Loan Amount (Principal): The total amount you wish to borrow.

- Interest Rate: The annual interest rate offered by the lender.

- Loan Tenure: The period over which you intend to repay the loan, usually in months or years.

- Processing Fees (optional): Some calculators offer the option to include additional charges like processing fees.

Benefits of Using a Loan Calculator

- Accurate Financial Planning: With the help of a loan calculator, you can accurately estimate your monthly EMI and total interest cost. This enables better financial planning, helping you avoid overextending your budget.

- Time-Saving: Manual EMI calculations can be tedious and error-prone. A loan calculator provides instant and accurate results with just a few clicks, saving you time and effort.

- Loan Comparison: When considering multiple loan offers, a loan calculator allows you to compare different interest rates, loan tenures, and principal amounts, helping you choose the most affordable option.

- Visualization of Repayment Schedule: Many advanced loan calculators provide detailed amortization schedules, showing the breakdown of your EMIs into principal and interest components. This helps you track how much of your EMI is going towards paying off the principal over time.

Types of Loans You Can Calculate

- Home Loan Calculator: Ideal for those planning to buy or construct a home. It helps calculate your EMIs for long-term loans with fixed or floating interest rates.

- Personal Loan Calculator: Whether for travel, education, or emergency expenses, this calculator helps estimate EMIs for short to medium-term personal loans.

- Car Loan Calculator: A useful tool for determining monthly payments on car loans, allowing you to budget for vehicle purchases efficiently.

- Education Loan Calculator: Helps students and parents plan for repayment based on loan terms and grace periods offered by educational institutions or banks.

Example: Using a Loan Calculator

Let’s assume you are considering a personal loan of ₹5,00,000 at an interest rate of 10% per annum for 5 years. By entering these values into the loan calculator, you can instantly see the following:

- Monthly EMI: ₹10,624

- Total Interest Payable: ₹1,37,448

- Total Amount Payable (Principal + Interest): ₹6,37,448

These results help you assess whether this loan fits your monthly budget and financial goals.

Conclusion

A loan calculator is a powerful tool for anyone looking to borrow money. It gives you clarity and control over your finances by helping you understand the monthly repayments and total interest costs upfront. By making informed decisions, you can ensure that your loan journey is smooth and stress-free.

Before applying for a loan, take advantage of a loan calculator to plan better, compare offers, and ultimately choose the most suitable loan option for your needs.

Are you looking to calculate your EMI? Try our Loan Calculator now and take the guesswork out of your financial planning!

A Comprehensive Guide to Loans: Types, Benefits, and How to Choose the Right One

In today’s world, loans have become a common way to finance important milestones in life—whether it’s buying a house, starting a business, pursuing higher education, or even taking a dream vacation. A loan gives you the financial boost to achieve your goals, but choosing the right type of loan and understanding its implications is key to long-term financial health.

In this blog, we will break down the basics of loans, the various types available, their benefits, and how to choose the right loan for your needs.

What is a Loan?

A loan is a sum of money borrowed from a financial institution or lender, which is repaid over time with added interest. The repayment is usually made in installments (monthly EMIs), and the loan comes with specific terms and conditions such as interest rates, repayment tenure, and fees. Loans can either be secured (requiring collateral) or unsecured (without collateral).

Types of Loans

1. Personal Loan:

- Purpose: Personal loans can be used for a variety of purposes, such as weddings, medical emergencies, travel, or home renovations.

- Features: It is an unsecured loan, meaning you don’t need to provide collateral.

- Interest Rate: Typically higher than secured loans, ranging from 10% to 24% per annum depending on your credit score.

- Repayment Tenure: Usually between 1 to 5 years.

2. Home Loan:

- Purpose: Used for purchasing or constructing a house, or for home renovations.

- Features: A secured loan where the property itself acts as collateral.

- Interest Rate: Relatively lower, ranging from 6.5% to 9% per annum, due to its secured nature.

- Repayment Tenure: Long-term, often between 10 to 30 years.

3. Car Loan:

- Purpose: Specifically designed for buying a new or used vehicle.

- Features: The car acts as collateral for the loan, and if you default, the lender has the right to repossess the vehicle.

- Interest Rate: Usually between 8% to 12%, with the tenure ranging from 1 to 7 years.

4. Education Loan:

- Purpose: To cover tuition fees and other education-related expenses for higher studies, either domestically or abroad.

- Features: Often comes with a moratorium period, where repayment begins only after course completion.

- Interest Rate: Varies between 8% to 15%, with longer tenures (up to 15 years) depending on the loan amount.

5. Business Loan:

- Purpose: For business expansion, working capital, or purchasing equipment.

- Features: Can be secured (backed by business assets) or unsecured, with flexible repayment options.

- Interest Rate: Usually ranges from 10% to 18%, depending on the nature of the business and its creditworthiness.

6. Gold Loan:

- Purpose: A short-term loan taken by pledging gold as collateral.

- Features: Secured loan with a relatively lower interest rate, typically between 7% and 12%.

- Repayment Tenure: Short-term, often between 6 months to 3 years.

7. Payday Loan:

- Purpose: A small, short-term loan meant to cover urgent financial needs until the next payday.

- Features: Quick approval but very high-interest rates and short repayment periods, typically within 30 days.

- Interest Rate: Can be extremely high, ranging from 30% to 100% APR or more.

8. Mortgage Loan:

- Purpose: A long-term loan taken against immovable assets, typically real estate.

- Features: The property is mortgaged as collateral, and the loan amount can be used for any personal or business needs.

- Interest Rate: Generally lower compared to unsecured loans, between 7% to 10%.

- Repayment Tenure: Often between 10 to 20 years.

Benefits of Taking a Loan

- Instant Financial Support: Loans provide immediate access to funds that can be used for major purchases or urgent needs without depleting your savings.

- Easy Repayment: Most loans come with flexible repayment options, allowing you to choose a tenure that suits your financial capability.

- Credit Score Improvement: Consistently repaying a loan on time can boost your credit score, making you eligible for better financial products in the future.

- Achieving Financial Goals: Loans make it easier to achieve your financial aspirations, whether it’s buying a dream home, starting a business, or funding your education.

- Tax Benefits: Some loans, like home loans and education loans, come with tax benefits under sections 80C and 80E of the Income Tax Act.

How to Choose the Right Loan?

- Evaluate Your Needs: Understand why you need the loan and how much you need. For example, if you’re buying a house, a home loan with a longer tenure may be more suitable than a personal loan.

- Interest Rates: Compare interest rates across various lenders. Secured loans generally have lower rates, while unsecured loans may come with higher rates.

- Loan Tenure: Choose a repayment period that you are comfortable with. A longer tenure reduces your EMI but increases the total interest paid, while a shorter tenure may increase the EMI but save on interest costs.

- Repayment Capacity: Assess your monthly budget and determine how much you can realistically pay as EMI without straining your finances.

- Processing Fees & Other Charges: Apart from interest rates, consider other costs like processing fees, late payment penalties, and prepayment charges.

- Collateral Requirements: Check if the loan requires collateral. For larger amounts, secured loans may be more affordable than unsecured options.

- Tax Benefits: If you are eligible for tax deductions on the loan, factor these benefits into your decision-making process.

Try More Calculators:

Conclusion

Loans are powerful financial tools that can help you achieve your personal and professional goals. However, choosing the right loan requires careful consideration of factors such as interest rates, tenure, and repayment capacity. By understanding the different types of loans available and their features, you can make an informed decision that supports your financial well-being in the long run.

Whether it’s buying a home, starting a business, or fulfilling personal needs, taking the right loan can be a steppingstone to achieving your dreams. Always do your research, compare offers, and plan your repayment strategy to ensure a smooth financial journey.

Looking for the best loan options? Explore our Loan Comparison Tool and find the perfect loan for your needs!