User Guide: How to Use the Salary Breakdown Calculator

The Salary Breakdown Calculator is a simple yet effective tool to help you compute your net salary after accounting for various components such as Basic Salary, HRA, Special Allowances, and deductions like taxes, Provident Fund (PF), and other deductions. This calculator provides a clear breakdown of your gross and net salary.

Explanation of the Code

HTML Section

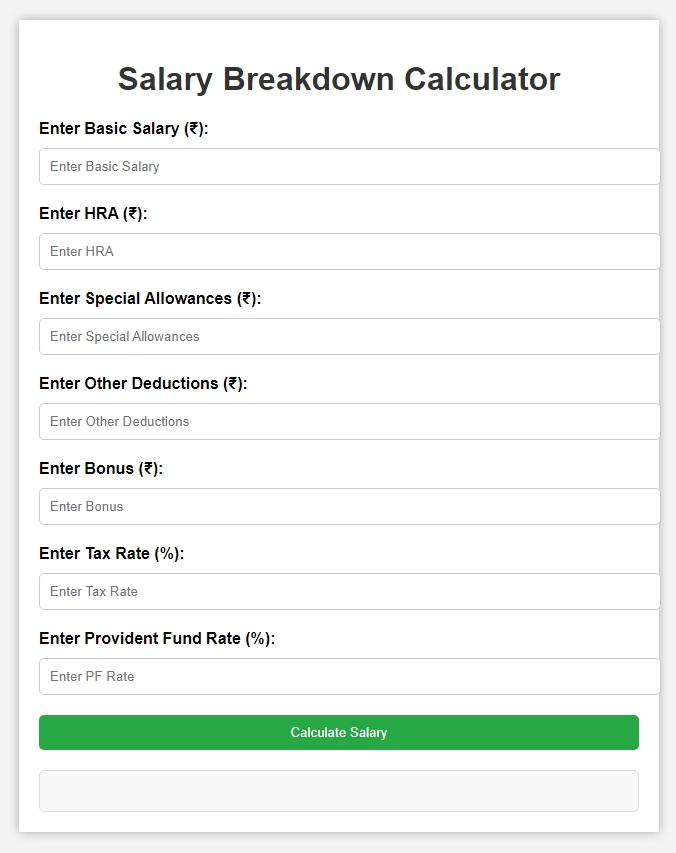

- The form includes fields for entering the basic salary, HRA, special allowances, other deductions, bonus, tax rate, and PF rate.

- Each input is validated to ensure that the user enters valid numeric values.

PHP Section

- The PHP code processes the form submission.

- It calculates the gross salary, total deductions (including tax, PF, and other deductions), and the net salary.

- The results are displayed back to the user.

Key Features

- Gross Salary Calculation: This includes the basic salary, HRA, special allowances, and bonus.

- Deductions Calculation: It considers tax, provident fund (PF), and any other deductions.

- Net Salary Calculation: The net salary is computed by subtracting total deductions from the gross salary.

This code offers a comprehensive salary calculator that users can utilize to calculate their advanced salary breakdown.

How to Use the Salary Breakdown Calculator

Steps to Use

Step 1. Open the Calculator

- Launch the Salary Breakdown Calculator in your web browser.

Step 2. Enter the Basic Salary

- Locate the field labeled “Enter Basic Salary (₹)”.

- Input your basic monthly salary in this field. For example, if your basic salary is ₹30,000, enter “30000”.

Step 3. Enter HRA (House Rent Allowance)

- Find the field labeled “Enter HRA (₹)”.

- Input your HRA amount. If you receive ₹10,000 as HRA, you should enter “10000”.

Step 4. Enter Special Allowances

- In the “Enter Special Allowances (₹)” field, input the amount you receive as special allowances. For instance, enter “5000” if you get ₹5,000.

Step 5. Enter Other Deductions

- In the “Enter Other Deductions (₹)” field, input any other deductions applicable to your salary. For example, if your other deductions amount to ₹2,000, enter “2000”.

Step 6. Enter Bonus

- In the “Enter Bonus (₹)” field, enter any bonuses you receive. For example, if you receive ₹3,000 as a bonus, enter “3000”.

Step 7. Input the Tax Rate

- In the field labeled “Enter Tax Rate (%)”, input the applicable tax rate percentage. For instance, if your tax rate is 10%, you should enter “10”.

Step 8. Input the Provident Fund Rate

- In the “Enter Provident Fund Rate (%)” field, input the PF rate. For example, if your PF contribution rate is 12%, enter “12”.

Step 9. Calculate the Salary

- After filling in all the required fields, click on the “Calculate Salary” button.

- The calculator will compute and display the following:

- Gross Salary: The total amount before deductions.

- Total Deductions: The sum of tax, PF, and other deductions.

- Net Salary: The final amount after all deductions.

Step 10. View the Results

- The results will be displayed in the “Results” section below the form.

- Review the breakdown of your salary to understand how the gross salary and various deductions contribute to your final net salary.

Step 11. Reset the Calculator (Optional)

- If you want to perform another calculation, you can use the “Reset” button to clear all the fields and start over.

Example Scenario

- Basic Salary: ₹40,000

- HRA: ₹15,000

- Special Allowances: ₹7,000

- Other Deductions: ₹2,500

- Bonus: ₹5,000

- Tax Rate: 12%

- Provident Fund Rate: 10%

Calculation

- Gross Salary = ₹40,000 (Basic Salary) + ₹15,000 (HRA) + ₹7,000 (Special Allowances) + ₹5,000 (Bonus) = ₹67,000

- Tax Deduction = ₹67,000 * 12% = ₹8,040

- PF Deduction = ₹40,000 * 10% = ₹4,000

- Total Deductions = ₹8,040 (Tax) + ₹4,000 (PF) + ₹2,500 (Other Deductions) = ₹14,540

- Net Salary = ₹67,000 – ₹14,540 = ₹52,460

The calculator will show that your net salary is ₹52,460 after all deductions.

The Salary Breakdown Calculator provides an easy and efficient way to compute your salary details, giving you a clear picture of your earnings after all deductions. This tool is valuable for budgeting and financial planning, ensuring you are well-informed about your take-home pay.

Try More Calculators:

Understanding Your Salary Breakdown: A Complete Guide to Calculating Your Net Salary

Managing your finances effectively starts with understanding your salary structure. One of the simplest ways to do this is by using a Salary Breakdown Calculator, a tool designed to give you a clear view of your earnings and deductions. In this blog post, we’ll explore how this calculator works, its components, and why it’s essential for every working professional.

What is a Salary Breakdown Calculator?

A Salary Breakdown Calculator is a simple yet powerful tool that helps you compute your net salary after considering various salary components. It takes into account earnings like Basic Salary, House Rent Allowance (HRA), Special Allowances, and deducts contributions like Provident Fund (PF), taxes, and other applicable deductions.

The result? A detailed view of both your gross salary (total earnings before deductions) and net salary (the actual amount you take home after deductions).

Components of a Salary Breakdown

To understand how the calculator works, it’s important to know the key components of a salary structure. Below are the major elements:

1. Basic Salary

This is the fixed base amount of your salary and forms the core of your earnings. It usually constitutes 40-50% of your total salary.

2. House Rent Allowance (HRA)

If you’re living in a rented accommodation, the HRA helps reduce your tax liability. The actual HRA you receive depends on your city of residence and whether you’re paying rent.

3. Special Allowances

These include components like transport, medical, or other allowances provided by your employer. These can be fully taxable or partially exempt, depending on the nature of the allowance.

4. Gross Salary

The gross salary is the total of all your earnings before any deductions. It includes the basic salary, HRA, and all allowances.

5. Provident Fund (PF)

Your employer deducts a portion of your salary for PF contributions, which is typically around 12% of your basic salary. This goes toward your retirement savings and is a long-term investment.

6. Professional Tax

Professional tax is a small, state-imposed tax, which varies based on the state in India. This is deducted from your salary each month.

7. Other Deductions

These include contributions to gratuity, income tax, or any loan repayments deducted directly from your salary.

How the Salary Breakdown Calculator Works

Using a Salary Breakdown Calculator is straightforward. You simply input your earnings and deductions, and the calculator instantly provides a breakdown of your total earnings and the deductions made from your salary. Here’s how the calculation works:

- Input Your Earnings: Enter your Basic Salary, HRA, and any special allowances. These components form the gross salary.

- Input Your Deductions: Enter details of Provident Fund, taxes, and any other deductions.

- Calculate: The calculator then adds up your earnings and deductions to give you a breakdown of:

- Total Earnings (Gross Salary)

- Total Deductions

- Net Salary (Take-home pay after deductions)

Why Use a Salary Breakdown Calculator?

A Salary Breakdown Calculator can be incredibly beneficial for several reasons:

1. Understand Your Take-Home Pay

Knowing your net salary is essential for budgeting and planning your finances. The calculator ensures you’re aware of how much money you’ll actually receive after all deductions.

2. Tax Planning

By understanding the breakdown of your salary, you can make smarter decisions about your tax-saving investments. For instance, by looking at how much goes toward HRA or PF, you can figure out the best way to optimize your tax liabilities.

3. Salary Negotiations

When negotiating a new job offer or a salary hike, it’s essential to know how the components of your salary affect your net pay. A higher gross salary doesn’t always mean more take-home pay due to deductions. The calculator provides clarity when negotiating a better deal.

4. Financial Planning

The calculator helps you plan for your future by showing how much is contributed to your retirement funds (like PF). This can be valuable when thinking about long-term financial goals such as buying a home or saving for retirement.

Example: Calculating Your Net Salary

Let’s say you’re earning the following:

- Basic Salary: Rs 40,000

- HRA: Rs 15,000

- Special Allowances: Rs 5,000

- Provident Fund: Rs 4,800 (12% of Basic Salary)

- Professional Tax: Rs 200

- Other Deductions: Rs 500

Here’s what the breakdown might look like:

- Gross Salary: Rs 60,000

- Total Deductions: Rs 5,500

- Net Salary: Rs 54,500

A Salary Breakdown Calculator is a simple but essential tool for every working professional. It provides transparency into how your salary is structured, helping you make informed financial decisions. Whether you’re planning your budget, preparing for tax season, or negotiating a new job offer, understanding your salary breakdown is key to achieving financial success.

Next time you receive your salary slip, use the calculator to get a better sense of your finances and make smarter choices for your future.