User Guide: How to Use the Salary Calculator

Code Explanation

HTML and JavaScript

- The user fills in the necessary salary details like CTC, bonus percentage, professional tax, and PF contributions.

- Once the form is submitted, the JavaScript function calculates the gross salary, monthly/annual deductions, and take-home salary based on user input.

- The result is displayed dynamically without reloading the page.

PHP

- This PHP snippet calculates the salary when the form is submitted via a POST request.

- It calculates bonus, gross salary, total deductions, and take-home salary and displays them.

- This script can be integrated into a form that sends data to the server, processes it, and returns results.

By combining PHP for server-side calculations and JavaScript for immediate client-side interaction, this calculator provides flexibility and usability for users wanting to compute their take-home salary accurately.

Improvements Made

- Color Scheme:

- A modern green color (#4CAF50) is used for buttons, titles, and highlights.

- Background is a light blue (#f0f8ff) to create a soothing effect.

- Text and form backgrounds use clean white and gray shades.

- Typography:

- Clear, modern fonts like ‘Segoe UI’, Tahoma, Geneva, Verdana, sans-serif for readability.

- Form Inputs:

- Inputs have a clean, simple design with hover and focus effects to improve user interaction.

- Submit button now has a hover effect to make it more visually appealing.

- Result Section:

- The result display area has a subtle shadow and rounded corners to give it a card-like appearance.

- Results are aligned centrally with prominent fonts for emphasis.

This design ensures a user-friendly experience with easy-to-read forms and well-organized data presentation.

How This Code Works

- HTML Form: The form collects input for CTC, bonus percentage, monthly deductions, and PF contributions.

- Form Submission: The form is submitted to the same page (using action=””). It sends the data via the POST method.

- PHP Processing: After form submission, PHP processes the input and calculates:

- Bonus

- Gross Salary

- Monthly and Annual Deductions

- Take-Home Monthly and Annual Salary

- Result Display: The results are displayed in the #result div after calculation.

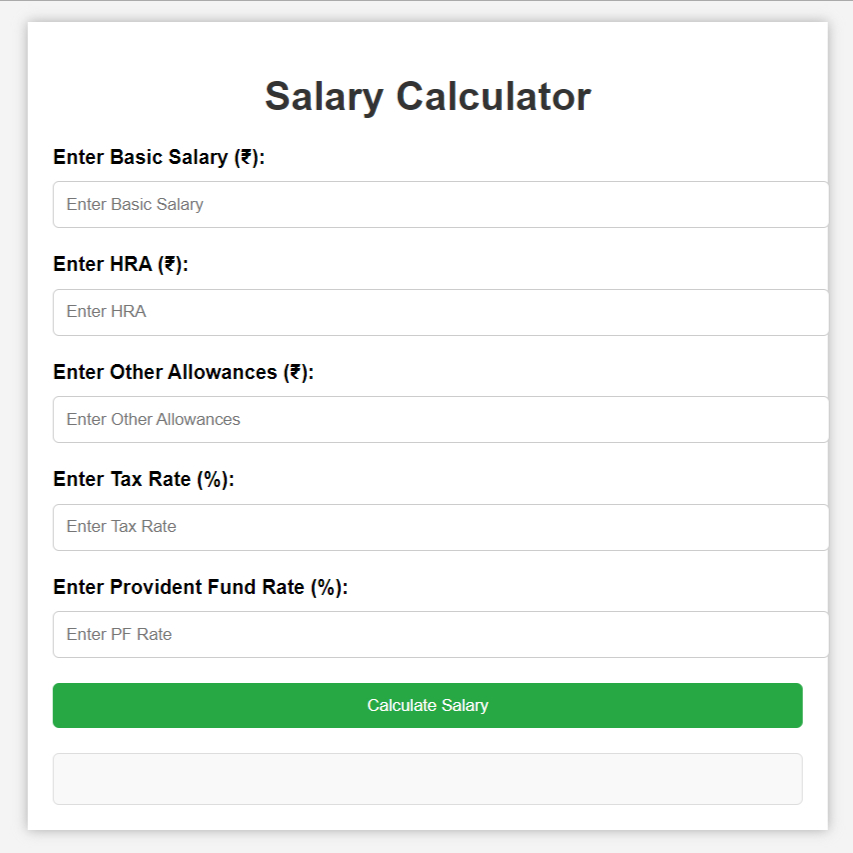

How to Use the Salary Calculator

The Salary Calculator helps you estimate your take-home salary by considering your Cost to Company (CTC), bonuses, and various deductions like taxes and Provident Fund (PF). Follow this guide to understand how to use it effectively.

Steps to Use the Salary Calculator

Step 1. Cost to Company (CTC) (₹)

- Enter your total annual CTC, which is the total amount your employer promises to pay you, including salary, bonuses, and any other perks.

- Example: If your CTC is ₹12,00,000, enter 1200000 in the input field.

Step 2. Bonus Included in CTC (%)

- Input the percentage of your CTC that is allocated as a bonus.

- Example: If 10% of your CTC is given as a bonus, enter 10 in this field.

Step 3. Monthly Professional Tax (₹)

- Enter the amount of professional tax deducted from your salary every month.

- Example: If your monthly professional tax is ₹200, enter 200.

Step 4. Monthly Employer PF (₹)

- Enter the Provident Fund (PF) contribution made by your employer each month.

- Example: If your employer contributes ₹1,800 towards your PF, enter 1800.

Step 5. Monthly Employee PF (₹)

- Enter the monthly PF contribution you make as an employee.

- Example: If your PF contribution is ₹1,800 per month, enter 1800.

Step 6. Monthly Additional Deduction (Optional) (₹)

- You can input any additional monthly deductions, like health insurance or loans. These fields are optional.

- Example: If you have an additional deduction of ₹500, enter 500.

Step 7. Click “Calculate Salary”

- After filling out all the fields, click the Calculate Salary button. The calculator will compute the results based on your inputs.

Understanding the Results

Once you submit the form, the following results will be displayed:

- Total Monthly Deductions:

- This shows the total of all monthly deductions (professional tax, employer PF, employee PF, and any additional deductions).

- Total Annual Deductions:

- This is the yearly total of your monthly deductions multiplied by 12.

- Take Home Monthly Salary:

- This is your net monthly salary after all deductions.

- Take Home Annual Salary:

- This is the net annual salary you will receive after all deductions.

By following these steps, you can accurately estimate your take-home salary and understand the impact of various deductions.

Example 1: Employee with Basic Deductions

Employee Details:

- CTC: ₹12,00,000

- Bonus Included in CTC: 10%

- Monthly Professional Tax: ₹200

- Monthly Employer PF: ₹1,800

- Monthly Employee PF: ₹1,800

- No additional deductions

Steps:

- Enter 1200000 in the Cost to Company (CTC) field.

- Enter 10 in the Bonus Included in CTC (%) field.

- Enter 200 in the Monthly Professional Tax field.

- Enter 1800 in the Monthly Employer PF field.

- Enter 1800 in the Monthly Employee PF field.

- Leave the Monthly Additional Deduction fields as 0.

Result:

- Total Monthly Deductions: ₹3,800

- Total Annual Deductions: ₹45,600

- Take Home Monthly Salary: ₹77,533.33

- Take Home Annual Salary: ₹9,30,400

How to Calculate Example 1: Employee with Basic Deductions

Employee Details:

- CTC: ₹12,00,000

- Bonus: 10%

- Professional Tax: ₹200 per month

- Employer PF: ₹1,800 per month

- Employee PF: ₹1,800 per month

- No Additional Deductions

Step-by-Step Calculation:

Calculate Annual Take Home Salary:

Annual Take Home Salary = Take Home Monthly Salary × 12

Annual Take Home Salary = ₹86,200 × 12 = ₹10,34,400

Calculate Bonus:

Bonus = (Bonus Percentage / 100) × CTC

Bonus = (10 / 100) × 12,00,000 = ₹1,20,000

Calculate Gross Salary:

Gross Salary = CTC – Bonus

Gross Salary = ₹12,00,000 – ₹1,20,000 = ₹10,80,000

Calculate Monthly Gross Salary:

Monthly Gross Salary = Gross Salary / 12

Monthly Gross Salary = ₹10,80,000 / 12 = ₹90,000

Calculate Monthly Deductions:

Monthly Deductions = Professional Tax + Employer PF + Employee PF

Monthly Deductions = ₹200 + ₹1,800 + ₹1,800 = ₹3,800

Calculate Take Home Monthly Salary:

Take Home Monthly Salary = Monthly Gross Salary – Monthly Deductions

Take Home Monthly Salary = ₹90,000 – ₹3,800 = ₹86,200

Example 2: Employee with Additional Deductions

Employee Details:

- CTC: ₹15,00,000

- Bonus Included in CTC: 12%

- Monthly Professional Tax: ₹250

- Monthly Employer PF: ₹2,000

- Monthly Employee PF: ₹2,000

- Additional Deduction 1: ₹500 (Health Insurance)

- Additional Deduction 2: ₹1,000 (Loan Repayment)

Steps:

- Enter 1500000 in the Cost to Company (CTC) field.

- Enter 12 in the Bonus Included in CTC (%) field.

- Enter 250 in the Monthly Professional Tax field.

- Enter 2000 in the Monthly Employer PF field.

- Enter 2000 in the Monthly Employee PF field.

- Enter 500 in the Monthly Additional Deduction 1 field.

- Enter 1000 in the Monthly Additional Deduction 2 field.

Result:

- Total Monthly Deductions: ₹5,750

- Total Annual Deductions: ₹69,000

- Take Home Monthly Salary: ₹92,500

- Take Home Annual Salary: ₹11,10,000

How to Calculate Example 2: Employee with Additional Deductions

Employee Details:

- CTC: ₹15,00,000

- Bonus: 12%

- Professional Tax: ₹250 per month

- Employer PF: ₹2,000 per month

- Employee PF: ₹2,000 per month

- Additional Deduction 1: ₹500 (Health Insurance)

- Additional Deduction 2: ₹1,000 (Loan Repayment)

Step-by-Step Calculation:

Calculate Annual Take Home Salary:

Annual Take Home Salary = Take Home Monthly Salary × 12

Annual Take Home Salary = ₹1,04,250 × 12 = ₹12,51,000

Calculate Bonus:

Bonus = (Bonus Percentage / 100) × CTC

Bonus = (12 / 100) × ₹15,00,000 = ₹1,80,000

Calculate Gross Salary:

Gross Salary = CTC – Bonus

Gross Salary = ₹15,00,000 – ₹1,80,000 = ₹13,20,000

Calculate Monthly Gross Salary:

Monthly Gross Salary = Gross Salary / 12

Monthly Gross Salary = ₹13,20,000 / 12 = ₹1,10,000

Calculate Monthly Deductions:

Monthly Deductions = Professional Tax + Employer PF + Employee PF + Additional Deduction 1 + Additional Deduction 2

Monthly Deductions = ₹250 + ₹2,000 + ₹2,000 + ₹500 + ₹1,000 = ₹5,750

Calculate Take Home Monthly Salary:

Take Home Monthly Salary = Monthly Gross Salary – Monthly Deductions

Take Home Monthly Salary = ₹1,10,000 – ₹5,750 = ₹1,04,250

Here’s a detailed confirmation of how the calculations match:

Live Example with Code Breakdown

Given:

- CTC: ₹5,00,000

- Bonus: ₹50,000

- Professional Tax: ₹2,400 per year

- EPF Contributions:

- Employee Contribution: ₹1,800 per month (₹21,600 per year)

- Employer Contribution: ₹1,800 per month (₹21,600 per year)

- Employee Insurance: ₹2,000 per year

Steps:

- Calculate Gross Salary:

- Gross Salary = CTC – Bonus

- Gross Salary = ₹5,00,000 – ₹50,000 = ₹4,50,000

- Calculate Total Deductions:

- Professional Tax = ₹2,400

- EPF Employee Contribution = ₹21,600

- EPF Employer Contribution = ₹21,600

- Employee Insurance = ₹2,000

- Total Deductions = Professional Tax + EPF (Employee Contribution) + EPF (Employer Contribution) + Employee Insurance

- Total Deductions = ₹2,400 + ₹21,600 + ₹21,600 + ₹2,000 = ₹47,600

- Calculate Take Home Salary:

- Take Home Salary = Gross Salary – Total Deductions

- Take Home Salary = ₹4,50,000 – ₹47,600 = ₹4,02,400

Code Logic Consistency

- Gross Salary Calculation:

- Code: Gross Salary = CTC – Bonus

- Example: Gross Salary = ₹5,00,000 – ₹50,000 = ₹4,50,000

- Monthly Deductions Calculation:

- Professional Tax: Deducted monthly and then annualized in the code.

- EPF Contributions: Both employee and employer contributions are included in the code.

- Additional deductions (like insurance) are included as optional in the code.

- Total Deductions Calculation:

- Code includes: Professional Tax + Employer PF + Employee PF + Additional Deductions

- Example: Total Deductions are summed correctly.

- Take Home Salary Calculation:

- Code: Take Home Salary = Gross Salary – Monthly Deductions

- Example: Take Home Salary = ₹4,50,000 – ₹47,600 = ₹4,02,400

Conclusion

The logic in the code aligns with the example calculation. The code accurately reflects the calculations as per the provided example, including deductions for EPF, professional tax, and additional deductions, ensuring the calculation of the take-home salary is correct.

Try More Calculators:

Understanding Salary: A Comprehensive Guide

Salary is a crucial aspect of our professional lives. It not only reflects the value of our work but also influences our lifestyle, financial planning, and overall well-being. In this blog post, we’ll explore various facets of salary, including its components, factors affecting it, and tips for negotiation.

Components of Salary

- Basic Salary: This is the core component of your salary and forms the basis for other allowances and benefits.

- Allowances: These include house rent allowance (HRA), dearness allowance (DA), travel allowance (TA), and more. They are provided to cover specific expenses.

- Bonuses: Performance-based incentives that reward employees for their contributions.

- Benefits: Non-monetary perks such as health insurance, retirement plans, and paid time off.

Factors Affecting Salary

- Industry: Different industries offer varying salary scales. For instance, tech and finance sectors typically offer higher salaries compared to others.

- Experience: More experienced professionals generally command higher salaries.

- Education: Higher educational qualifications can lead to better-paying jobs.

- Location: Salaries can vary significantly based on the cost of living in different regions.

- Company Size: Larger companies often have more resources to offer competitive salaries.

Tips for Salary Negotiation

- Research: Know the average salary for your position and industry.

- Highlight Achievements: Demonstrate your value by showcasing your accomplishments.

- Be Confident: Approach the negotiation with confidence and professionalism.

- Consider the Whole Package: Evaluate the entire compensation package, including benefits and bonuses.

- Be Prepared to Walk Away: If the offer doesn’t meet your expectations, be ready to explore other opportunities.

Conclusion

Understanding the various aspects of salary can empower you to make informed decisions about your career. Whether you’re negotiating a new job offer or seeking a raise, being well-prepared and knowledgeable can significantly impact your financial future.

Feel free to share your thoughts or ask any questions you might have about salaries!

Understanding Salary Calculators: A Comprehensive Guide

In today’s fast-paced world, managing finances effectively is crucial. One of the tools that can help you understand your earnings better is a salary calculator. Whether you’re negotiating a new job offer, planning your budget, or simply curious about your take-home pay, a salary calculator can provide valuable insights. In this blog post, we’ll explore what a salary calculator is, how it works, and why it’s beneficial.

What is a Salary Calculator?

A salary calculator is an online tool that helps you determine your net pay after deductions such as taxes, insurance, and other withholdings. It can convert your annual salary into different pay frequencies, such as hourly, daily, weekly, bi-weekly, monthly, and yearly. This tool is particularly useful for understanding how much money you’ll actually take home, which can be quite different from your gross salary.

How Does a Salary Calculator Work?

- Input Your Details: You start by entering your gross salary, which is your total earnings before any deductions.

- Select Pay Frequency: Choose how often you get paid (e.g., monthly, bi-weekly).

- Include Deductions: Add any deductions such as federal and state taxes, Social Security, Medicare, and other withholdings.

- Calculate: The calculator processes this information to give you an estimate of your net pay.

Benefits of Using a Salary Calculator

- Financial Planning: Knowing your net pay helps you create a realistic budget and manage your expenses more effectively.

- Salary Negotiation: Understanding your take-home pay can give you a better position when negotiating salaries or raises.

- Tax Planning: It helps you anticipate your tax liabilities and plan accordingly.

- Comparing Job Offers: If you’re considering multiple job offers, a salary calculator can help you compare the net pay from each offer, taking into account different tax rates and benefits.

Popular Salary Calculators

- CalculatorKart.com: It provides various types of salary calculators.

- Calculator.net: This tool converts salary amounts to different payment frequencies and accounts for holidays and vacation days.

- SmartAsset: Offers a detailed breakdown of your take-home pay after federal, state, and local taxes.

- PaycheckCity: Allows you to see how changes in your paycheck affect your tax results.

- Indeed: Customizes calculations by including or excluding unpaid time, such as vacation hours or holidays.

- Gusto: Determines withholdings and calculates take-home pay for salaried employees.

Conclusion

A salary calculator is an invaluable tool for anyone looking to gain a clearer understanding of their finances. By providing detailed insights into your net pay, it helps you make informed decisions about your career and financial planning. Whether you’re negotiating a new job offer or planning your monthly budget, a salary calculator can make the process simpler and more transparent.

Feel free to share your thoughts or ask any questions you might have about salary calculators!