Simplifying Tax Calculations: Introducing the TDS Calculator

Tax season can be a stressful time for many, especially when it comes to understanding and calculating Tax Deducted at Source (TDS). To make this process easier, we introduce the TDS Calculator—a simple, user-friendly tool designed to help you quickly and accurately determine your TDS amount. Whether you’re a salaried employee, a freelancer, or a business owner, this calculator can save you time and effort.

What is TDS?

TDS stands for Tax Deducted at Source. It is a means of collecting income tax in India, where a certain percentage is deducted from payments such as salaries, interest, rent, and professional fees. The deducted amount is then remitted to the government. TDS ensures that tax is collected in advance and helps in reducing tax evasion.

Why Use a TDS Calculator?

Calculating TDS manually can be complex and prone to errors. A TDS Calculator simplifies this task by automating the calculations, ensuring accuracy, and providing instant results. Here are some key benefits:

- Accuracy: Eliminates the risk of manual calculation errors.

- Time-Saving: Quickly computes TDS, saving you valuable time.

- User-Friendly: Easy to use, even for those with limited tax knowledge.

- Instant Results: Provides immediate calculations, helping you plan your finances better.

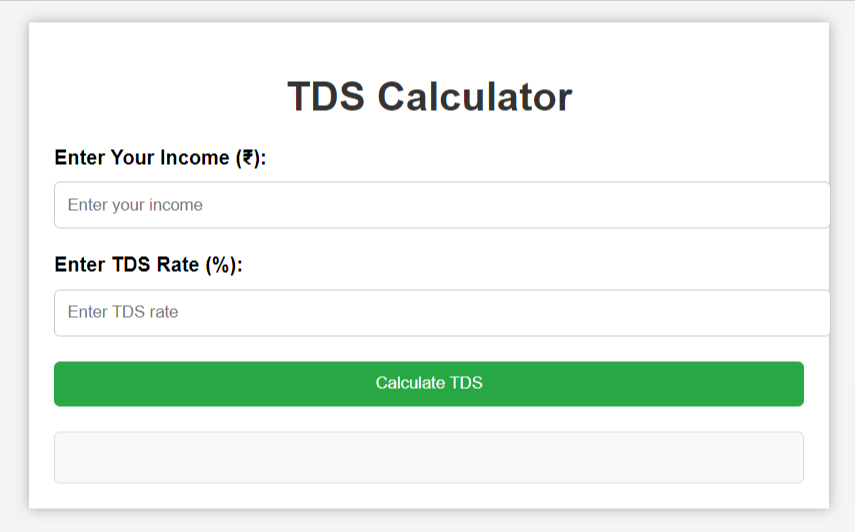

How It Works

- User Input:

- The user enters their total income and the applicable TDS rate (in percentage) into the input fields.

- TDS Calculation:

- The TDS (Tax Deducted at Source) is calculated by multiplying the income by the TDS rate.

- The net income after TDS is then calculated by subtracting the TDS amount from the total income.

- Results Display:

- The calculated TDS amount and net income after TDS are displayed on the screen.

Example

- If you enter an income of ₹1,00,000 and a TDS rate of 10%:

- The TDS amount will be ₹10,000.

- Your net income after TDS will be ₹90,000.

This tool provides a quick and easy way to calculate the tax deducted at source and understand how much income you will retain after TDS.

How to Use the TDS Calculator

Using the TDS Calculator is straightforward. Follow these simple steps:

- Enter Your Income: Input your total income in the designated field.

- Enter the TDS Rate: Specify the applicable TDS rate.

- Calculate: Click the “Calculate TDS” button to see the results.

The calculator will display the TDS amount and your net income after TDS deduction.

Example

Let’s say your annual income is ₹10,00,000, and the applicable TDS rate is 10%. Here’s how the calculation works:

- Income: ₹10,00,000

- TDS Rate: 10%

- TDS Amount: ₹1,00,000 (10% of ₹10,00,000)

- Net Income After TDS: ₹9,00,000

The TDS Calculator will instantly provide these results, making it easy for you to understand your tax obligations.

Behind the Scenes: How It Works

The TDS Calculator is built using HTML, CSS, and JavaScript. Here’s a brief overview of its components:

- HTML: Structures the content and layout of the calculator.

- CSS: Styles the calculator, ensuring a clean and user-friendly interface.

- JavaScript: Handles the calculations and updates the results dynamically.

Conclusion

The TDS Calculator is a valuable tool for anyone looking to simplify their tax calculations. By automating the process, it ensures accuracy, saves time, and provides instant results. Whether you’re preparing for tax season or just want to stay on top of your finances, the TDS Calculator is here to help.

Try the TDS Calculator today and take the hassle out of tax calculations!

Feel free to share this blog post on your website or social media to help others simplify their tax calculations. If you have any questions or need further assistance, don’t hesitate to reach out!

Understanding and Using a TDS Calculator: A Comprehensive Guide

Tax Deducted at Source (TDS) is a critical component of the Indian tax system. It ensures that tax is collected at the source of income, making the tax collection process more efficient and less prone to evasion. For individuals and businesses alike, calculating TDS accurately is essential for proper financial planning and compliance with tax regulations. In this blog post, we’ll dive into the concept of TDS, the benefits of using a TDS calculator, and how you can use one effectively to manage your tax obligations.

What do you mean by TDS?

TDS stands for Tax Deducted at Source. It is a system where the payer of income (like an employer or a bank) deducts tax before making the payment to the payee (like an employee or a depositor). This deducted amount is then deposited with the government. TDS is applicable on various types of income, including salaries, interest, rent, and professional fees. The rates of TDS can vary based on the type of income and applicable tax laws.

Why Use a TDS Calculator?

A TDS calculator simplifies the process of calculating the amount of tax to be deducted from your income. Here are some compelling reasons to use a TDS calculator:

- Accuracy: Manual calculations can be prone to errors, especially when dealing with complex tax rules and varying rates. A TDS calculator automates these calculations, reducing the risk of mistakes.

- Time-Saving: Calculating TDS manually can be time-consuming, especially if you have multiple sources of income. A calculator speeds up the process and provides quick results.

- Financial Planning: Knowing your TDS amount helps in planning your finances better. It allows you to understand how much of your income will be deducted and how it will impact your overall financial situation.

- Compliance: Using a TDS calculator helps ensure that you comply with tax regulations by accurately calculating the tax to be deducted, thereby avoiding potential penalties for incorrect deductions.

How to Use a TDS Calculator

Using a TDS calculator is straightforward. Here’s a step-by-step guide on how you can use one effectively:

1. Gather Your Financial Information

Before you start, make sure you have the following details:

- Income Amount: The total amount of income on which TDS needs to be calculated.

- TDS Rate: The percentage rate at which TDS is to be deducted. This rate can vary based on the type of income and applicable tax laws.

2. Input Your Details

Once you have the necessary information, enter the following details into the TDS calculator:

- Income Amount: Enter the total income you have earned.

- TDS Rate: Enter the applicable TDS rate as a percentage.

3. Calculate TDS

After entering the details, the calculator will automatically compute:

- TDS Amount: The total amount of tax that will be deducted from your income.

- Net Income: The amount you will receive after TDS deduction.

4. Review the Results

The calculator will display the following information:

- Income: The original amount of income.

- TDS Rate: The rate of tax deduction.

- TDS Amount: The computed amount of TDS.

- Net Income After TDS: The income remaining after TDS deduction.

Example Calculation

Let’s go through an example to illustrate how a TDS calculator works:

- Income: ₹5,00,000

- TDS Rate: 10%

Using the TDS calculator:

- TDS Amount: (₹5,00,000 * 10) / 100 = ₹50,000

- Net Income After TDS: ₹5,00,000 – ₹50,000 = ₹4,50,000

So, with an income of ₹5,00,000 and a TDS rate of 10%, you would have ₹50,000 deducted as TDS, and your net income would be ₹4,50,000.

Conclusion

A TDS calculator is an invaluable tool for individuals and businesses alike. It simplifies the process of calculating TDS, ensures accuracy, saves time, and aids in financial planning. Whether you’re managing your personal finances or handling payroll for a business, using a TDS calculator can help you stay compliant with tax regulations and avoid potential errors.

If you’re interested in using a TDS calculator, we’ve developed a user-friendly tool that can be integrated into your website or used as a standalone application. Try it out today and streamline your TDS calculations with ease!

For any further queries or if you need assistance with tax-related matters, feel free to reach out. We’re here to help you navigate the complexities of TDS and ensure that your financial planning is on track.

Understanding TDS: A Comprehensive Guide to Tax Deducted at Source

Tax Deducted at Source (TDS) is a key component of India’s tax system, designed to simplify tax collection and reduce tax evasion. Whether you’re an individual employee, a freelancer, or a business owner, understanding TDS is crucial for managing your finances and staying compliant with tax regulations. In this blog post, we’ll explore what TDS is, how it works, its benefits, and how you can manage it effectively.

What is TDS?

TDS stands for Tax Deducted at Source. It is a mechanism where the person responsible for making a payment (the payer) deducts a certain percentage of tax before disbursing the payment to the recipient (the payee). The deducted amount is then paid directly to the government. This system ensures that tax is collected at the source of income, rather than waiting until the end of the financial year for taxpayers to settle their tax dues.

Types of Income Covered by TDS

TDS applies to various types of income, including:

- Salaries: Employers deduct TDS from employees’ salaries based on applicable income tax slabs.

- Interest Income: Banks and financial institutions deduct TDS on interest earned from deposits if it exceeds a certain threshold.

- Rental Income: TDS is deducted on rental payments if the amount exceeds a specified limit.

- Professional Fees: Payments made to professionals (e.g., consultants, doctors) are subject to TDS.

- Dividends: Companies deduct TDS on dividends distributed to shareholders.

- Commission and Brokerage: TDS is deducted on commission and brokerage payments.

How TDS Works

The TDS process involves several steps:

- Deduction: The payer deducts tax at the source before making the payment. The rate of TDS depends on the type of income and applicable tax laws.

- Deposit: The deducted amount is deposited with the government by the payer.

- Certificate: The payer provides a TDS certificate to the payee, which includes details of the amount deducted and deposited. This certificate is essential for the payee to claim credit for the tax deducted.

- Filing Returns: The payer must file TDS returns periodically, providing details of the deductions made and deposited.

- Credit: The payee can claim credit for the TDS while filing their annual income tax return, which is adjusted against their total tax liability.

Benefits of TDS

- Reduces Tax Evasion: By collecting tax at the source, TDS minimizes the chances of tax evasion and ensures timely revenue collection for the government.

- Ease of Payment: TDS simplifies the tax payment process for individuals, as the responsibility for deduction and payment lies with the payer.

- Regular Cash Flow: For the government, TDS ensures a regular flow of tax revenue throughout the financial year.

- Tax Planning: Individuals and businesses can plan their finances better by knowing the exact amount of tax that will be deducted.

TDS Rates and Thresholds

The TDS rates and thresholds vary based on the type of income and the tax regulations in force. For example:

- Salaries: TDS is deducted based on income tax slabs applicable to the individual.

- Interest Income: Banks deduct TDS if the interest earned exceeds ₹40,000 in a financial year (₹50,000 for senior citizens).

- Rent: TDS is deducted if the annual rent exceeds ₹2,40,000.

How to Manage TDS

- Verify Deductions: Regularly check the TDS deductions made by your employer or other payers to ensure accuracy.

- Collect TDS Certificates: Ensure that you receive TDS certificates from your employer, bank, or any other entity making payments to you.

- File Returns: Keep track of TDS returns filed by your payers and ensure that they match your records.

- Claim Credit: When filing your income tax return, ensure that you claim credit for all TDS deducted, as this will reduce your overall tax liability.

Common Issues and Resolutions

- Incorrect Deduction: If TDS is deducted incorrectly, contact the payer to rectify the error and ensure that a revised TDS certificate is issued.

- Non-Receipt of TDS Certificate: If you do not receive a TDS certificate, follow up with the payer to obtain it, as it is essential for claiming TDS credit.

- Mismatch with Income Tax Records: In case of discrepancies between TDS records and your income tax return, reconcile the differences with the payer and file a correction if necessary.

Conclusion

Tax Deducted at Source (TDS) is a vital aspect of the Indian tax system, designed to streamline tax collection and ensure compliance. By understanding how TDS works and how to manage it effectively, you can ensure that your tax obligations are met and avoid potential issues. Whether you’re an employee, freelancer, or business owner, staying informed about TDS will help you plan your finances better and comply with tax regulations.

If you have any questions about TDS or need assistance with tax-related matters, feel free to reach out. We’re here to help you navigate the complexities of TDS and ensure that your financial planning is on track.

Try More Calculators:

- GST Calculator

- Inflation Calculator

- Future Value Inflation Calculator

- Income Tax Calculator

- Advanced Income Tax Calculator

Disclaimer

The information provided in this blog post is intended for general informational purposes only. While we strive to ensure that the information is accurate and up-to-date, tax laws and regulations can change frequently and may vary depending on individual circumstances.

No Professional Advice: This blog post does not constitute professional tax advice. For specific guidance related to your personal or business financial situation, please consult with a qualified tax advisor or financial professional.

Accuracy of Information: Although we make efforts to provide accurate information, we cannot guarantee that the content is free from errors or omissions. The use of any information provided in this blog is at your own risk.

No Liability: We accept no responsibility for any decisions made or actions taken based on the information provided in this blog. Any reliance on the information is solely at your own discretion.

Consultation with Professionals: Always seek professional advice before making financial or tax-related decisions. Your tax situation may be unique, and a qualified professional can provide personalized advice that considers your specific needs and circumstances.

Changes in Laws: Tax laws and regulations are subject to change. It is important to stay informed about current tax laws and consult with a tax professional to ensure compliance and optimize your tax strategy.

For any specific queries or concerns, please contact a certified tax advisor or financial consultant.