User Guide: How to Use the Unified Pension Scheme Calculator

Code Explanation

- Basic Pay + DA: User inputs the average of the last 12 months’ basic pay plus dearness allowance (DA).

- Service Years: The user inputs the total number of years the employee has worked.

- Service Months: The user inputs the total number of months the employee has worked.

Total Months of Service: A new input field has been added to allow users to enter the total months of service separately from the years. This input is necessary for calculating the pension and lump-sum payment more accurately. - Employee’s Contribution: The employee’s contribution is set at 10% and is read-only.

- Government’s Contribution: The government’s contribution is set at 18.5% and is read-only.

- Pension Calculation: The pension amount is calculated as 50% of the average basic pay + DA for the last 12 months. If the employee’s service is less than 25 years, the pension is proportionally reduced. A minimum pension of Rs 10,000 is guaranteed.

- Proportionate Pension Calculation: The pension is calculated based on the total months of service. If the service period is less than 300 months (25 years), the pension amount is proportionately reduced.

- Family Pension: Calculated as 60% of the pension amount.

- Lump-Sum Payment: The lump-sum payment is calculated as 1/10th of the average basic pay + DA for every six months of service.

- Total Service Calculation: The serviceYears and serviceMonths are combined into totalServiceMonths for more precise calculations.

- Lump-sum Payment Calculation: The lump-sum payment is based on the total service months, considering the total emoluments and service duration.

Features

- Color Scheme: The color palette uses shades of blue and green for a refreshing look.

- Interactive Elements: The form fields change border color when focused, providing visual feedback.

- User-Friendly Design: Rounded corners, shadow effects, and clean layout ensure readability and ease of use.

This design should make the calculator more appealing and engaging for users.

Usage

- Enter Basic Pay + DA: Input the average basic pay + DA for the last 12 months.

- Enter Service Years: Input the total years of service.

- Calculate Pension: Click on “Calculate Pension” to get the results for pension amount, family pension, and lump-sum payment.

This tool helps users estimate their pension benefits under the Unified Pension Scheme based on their salary and years of service.

How to Work

- Form Inputs:

- Basic Salary: Input for the basic salary amount.

- DA Amount: Input for the dearness allowance amount.

- Years and Months of Service: Inputs for calculating the tenure.

- Logic:

- Total Pension Calculation: 50% of basic salary + 50% of DA.

- Calculated Pension: Proportional if service tenure is less than 25 years.

- Minimum Pension: Ensures a minimum pension of ₹10,000.

- Family Pension: 60% of the final employee pension.

- Lump Sum Benefit: Calculated based on the monthly emoluments and completed six-month periods.

- Display Results: The results section shows the calculated pension, family pension, and lump sum benefit after the calculations.

This code can be used as a starting point, and additional logic can be added if needed to cover other aspects of the Unified Pension Scheme.

Changes Made

- DA as a Percentage: Added a new input field for DA as a percentage of the Basic Pay.

- DA Calculation: The DA amount is calculated by applying the percentage to the Basic Pay.

- Total Emoluments: The total emoluments are calculated by adding the Basic Pay and the calculated DA amount.

How It Works

It then calculates the total emoluments and uses this for the pension, family pension, and lump-sum payment calculations.

Basic Pay is entered along with DA Percentage.

The calculator determines the DA amount based on the percentage of Basic Pay.

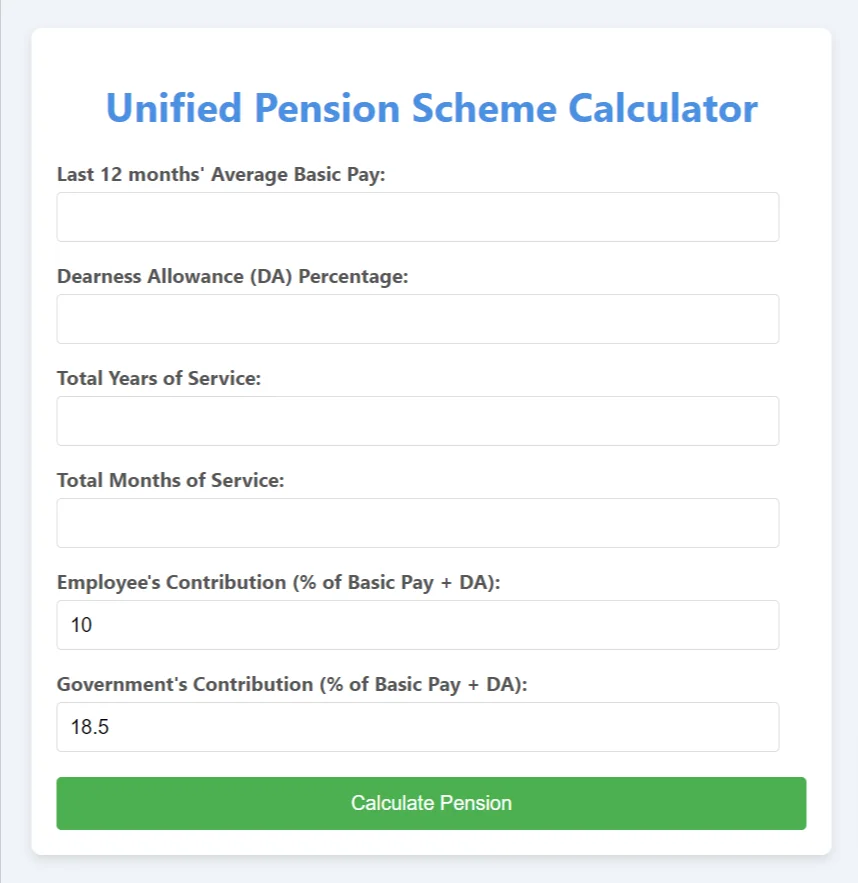

How to Use the Unified Pension Scheme Calculator

Unified Pension Scheme Calculator is a tool designed to help you estimate your pension amount, family pension, and lump-sum payment based on your service years, basic pay, and other relevant factors.

Follow the steps below to use the calculator effectively:

Step 1: Last 12 months’ Average Basic Pay

- Enter the average of your basic pay for the last 12 months.

- This amount should reflect your monthly basic salary over the last year.

Step 2: Dearness Allowance (DA) Percentage

- Enter the percentage of Dearness Allowance (DA) that you receive on your basic pay.

- This percentage is typically provided by your employer and is subject to periodic revisions.

Step 3: Total Years of Service

- Enter the total number of complete years you have worked.

- Include all full years of service up to the current date.

Step 4: Total Months of Service

- Enter the additional months of service that do not add up to a full year.

- For example, if you have worked for 10 years and 8 months, enter “10” in the “Total Years of Service” field and “8” in the “Total Months of Service” field.

Step 5: Employee’s Contribution (% of Basic Pay + DA)

- This field shows the percentage of your salary that you contribute to the pension scheme.

- The value is typically fixed (e.g., 10%) and is provided by your employer.

Step 6: Government’s Contribution (% of Basic Pay + DA)

- This field shows the percentage contribution made by the government towards your pension.

- The value is typically fixed (e.g., 18.5%) and is provided by your employer.

Step 7: Calculate Pension

- After entering all the required details, click on the “Calculate Pension” button.

- The calculator will display the following results:

- Pension Amount: The estimated monthly pension you will receive.

- Family Pension: The estimated monthly pension that your family will receive in case of your death.

- Lump-sum Payment: The one-time lump-sum payment you may be eligible for, based on your service duration.

Step 8: Review the Results

- The results will be displayed in a box below the form.

- The figures provided are estimates based on the information you entered and are subject to final determination by the pension authority.

Example

Let’s assume your last 12 months’ average basic pay is Rs 7,000, the DA percentage is 30%, and you have completed 15 years and 6 months of service.

- Last 12 months’ Average Basic Pay: 7000

- Dearness Allowance (DA) Percentage: 30

- Total Years of Service: 15

- Total Months of Service: 6

After entering these details and clicking on “Calculate Pension,” the calculator will show you the estimated pension, family pension, and lump-sum payment.

This guide should help you use the calculator effectively and understand the results it provides.

Try More Calculator:

- Salary Breakdown Calculator

- BMI Calculator (Body Mass Index)

- Random Number Generator

- Fraction Calculator

- Percentage Calculator

Detailed Calculations 1: Example of an Employee Using the Unified Pension Scheme Calculator

To illustrate how the Unified Pension Scheme (UPS) Calculator works, let’s consider a real-life example of an employee named Ravi Kumar. Ravi has been in government service for several years and is planning for his retirement. Below are the details Ravi inputs into the calculator and the detailed calculations that follow.

Employee Details

- Name: Ravi Kumar

- Last 12 Months’ Average Basic Pay: ₹60,000

- Dearness Allowance (DA) Percentage: 20%

- Total Years of Service: 22 years

- Employee’s Contribution: 10% (pre-set)

- Government’s Contribution: 18.5% (pre-set)

Step-by-Step Calculations

- Calculate DA Amount

- Calculate Total Emoluments

- Calculate Pension Amount

- Calculate Family Pension

- Calculate Lump-sum Payment

Summary of Calculations

- Pension Amount: ₹31,680 per month

- Family Pension: ₹19,008 per month

- Lump-sum Payment: ₹31,68,000

Results

Based on the inputs provided by Ravi Kumar and the detailed calculations performed by the UPS Calculator, Ravi can expect the following benefits upon retirement:

- A monthly pension of ₹31,680

- A family pension of ₹19,008

- A lump-sum payment of ₹31,68,000

This example illustrates how the Unified Pension Scheme Calculator helps employees like Ravi Kumar plan for their retirement by providing a clear estimate of their pension benefits.

Detailed Calculations 2: Example of an Employee with a Basic Salary of ₹7,000

Let’s consider an example where an employee, Anita Sharma, has a relatively low basic salary of ₹7,000. Anita is nearing retirement and wants to use the Unified Pension Scheme (UPS) Calculator to understand her pension benefits. Below are the details Anita inputs into the calculator and the detailed calculations that follow.

Employee Details

- Name: Anita Sharma

- Last 12 Months’ Average Basic Pay: ₹7,000

- Dearness Allowance (DA) Percentage: 20%

- Total Years of Service: 18 years

- Employee’s Contribution: 10% (pre-set)

- Government’s Contribution: 18.5% (pre-set)

Step-by-Step Calculations

- Calculate DA Amount

- Calculate Total Emoluments

- Calculate Pension Amount

- Calculate Family Pension

- Calculate Lump-sum Payment

Summary of Calculations

- Pension Amount (Adjusted to Minimum): ₹10,000 per month

- Family Pension: ₹6,000 per month

- Lump-sum Payment: ₹15,12,000

Conclusion

Based on Anita Sharma’s inputs and the detailed calculations performed by the UPS Calculator, despite her low basic salary, Anita can expect the following benefits upon retirement:

- A monthly pension of ₹10,000 (adjusted to the minimum pension threshold)

- A family pension of ₹6,000

- A lump-sum payment of ₹15,12,000

This example demonstrates how the Unified Pension Scheme Calculator ensures that even employees with lower salaries receive a minimum pension amount, providing a safety net for their post-retirement life.

[Disclaimer: The examples provided are for illustrative purposes only to explain the benefits of the scheme. Individual pension amounts and lump-sum payments may vary based on factors such as service duration, last drawn salary, and applicable rules at the time of retirement.]